Latency

Wavelength Podcast Ep. 204: Nasdaq on Cloud Strategy

Nikolai Larbalestier, head of cloud strategy at Nasdaq, joins the podcast to talk about cloud computing and cloud adoption.

HPR Preps Market Data Entry with Databot

The Massachusetts-based infrastructure provider is looking to become a one-stop shop in the low-latency trading space.

MayStreet Gets $21M Funding to Support Cost of Data Expansion

The vendor will use the funding to expand its data collection activities worldwide and hire resources to staff the effort.

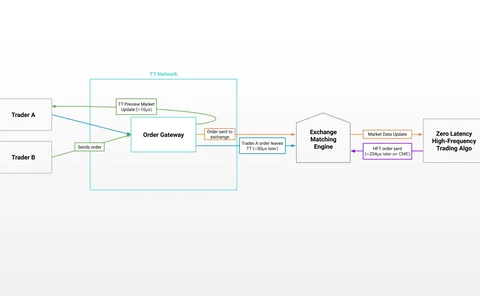

Trading Technologies Unveils New Futures Market Data Feed

As the fight over market data fees in the futures market heats up, the Chicago-based trading platform provider is rolling out a new platform that provides a free view of market order flow for TT platform users.

This Week: ICE, Nasdaq/R3, BMLL/OpenFin, DASH

A summary of some of the past week’s financial technology news.

Nasdaq Taps AWS for Market Data Cloud

The initiative will make all of Nasdaq's market data available to potential clients via APIs in Amazon Web Services' cloud, as an alternative to its traditional feed and file delivery options.

In Expansion Beyond HFT, FPGAs Eye AI

After a decade of supercharging low-latency applications, Wei-Shen Wong explores how FPGAs are pushing into new areas of the capital markets, driven by interest in AI & ML.

Colt Cuts Japan–Hong Kong Latency to Sub-41ms

Beyond new latency reductions between Tokyo and Hong Kong, Colt will continue to optimize its routes and expand its network coverage.

This Week: Charles River, Broadridge/IBM, Dash, TT, GAM/SimCorp

A summary of some of the past week’s financial technology news.

5G & IoT: Are You Ready for the Data Deluge?

The combination of these two revolutions will see data volumes skyrocket. As a result, Anthony Malakian says data providers will be able to find new datasets to package for clients, while investment firms can create unique investment insights.

Avelacom Adds Multi-Cloud Connectivity for Crypto Traders

Direct links set up in each location “jump” from points-of-presence to a cloud in under a millisecond.

This Week: Goldman/Finos; JP Morgan/Baton; Caixa AM; IHS Markit

Catch up on some of the past week's financial technology news.

Fixnetix Beefs Up NY Presence for US Push

The vendor plans to exploit the larger footprint of parent DXC and to launch new services in the US.

Firms Struggle with SM&CR Compliance and Preparations

As all FCA-regulated firms will fall into scope of the Senior Managers and Certification Regime by the end of the year, concerns emerge on how to implement the regulation.

Desktop App Interoperability: On the Front Lines with RBC and OpenFin

Anthony Malakian spent several weeks with RBC Capital Markets and OpenFin to see how desktop app interoperability works in motion.

TNS Hires Fintech, Data Sales Exec Burke for BizDev

Burke has also worked at CJC, FIS and Activ Financial, covering sales, service, and account management.

Liquidnet Builds Netflix-like Functionality for Buy Side

The company is leveraging AI to make investment suggestions and dig out sentiment from spoken announcements.

MOEX Sees New Network as Key to Asia Arbitrage Opportunities

Exchange hopes to exploit Avelacom's network PoPs in Asian countries to encourage trade flow from the region.

Wavelength Episode 163: Tony Amicangioli on Cloud, Race to Zero

The founder and CEO of HPR joins the podcast to talk about lessons learned and where the industry is heading.

Bank, Fintech Exec Gonzalez Joins Pico to Lead Americas Sales

Gonzalez has 20 years of experience in technology management and sales at financial firms and technology providers.

Not Random, and Not a Forest: Black-Box ML Turns White

Bayesian analysis can replace random forest with a single, powerful tree, writes UBS’s Giuseppe Nuti.

Pico Continues Infrastructure Upgrade

It has added new dark fiber capabilities in NY and is rolling out L1 venue connections.

Avelacom Sets Up Thai PoP

The provider will be upgrading its APAC infrastructure by opening new routes, particularly to connect with the US.

SEC’s Redfearn: US-Style Consolidated Tapes Won’t Solve Trading Data Needs

As European market participants bemoan the lack of a consolidated tape, a senior SEC executive debunks the idea that a pan-European tape, similar to the US, will resolve issues around data access and costs.