ISDA

Isda doubles down on digital push with new tech team

The new division is tasked with identifying new areas for standardization.

Simm May Come with a Side Benefit—A Common Data Standard

Buy-side firms using AcadiaSoft for Simm calculations must adopt the ORE XML data format.

People Moves: ISDA, ASX, Eventus Systems and CLS

A look at some of the key "people moves" from this week, including Keith Tippell (pictured) who joins CLS as head of product.

This Week: BNY Mellon; Amazon/Digital Asset; TP ICAP; Hazeltree; SimCorp & More

A summary of some of the past week's financial technology news.

Barclays: The Future of Post-Trade is a Common Utility Platform

Financial firms are pushing for a distributed market infrastructure model through efforts like Isda's Common Domain Model and distributed ledger technology.

With Initial Margin 'Big Bang' Split, Tech Preparations Could be Impacted

As the final phase of the IM implementation for non-cleared derivatives has been split into two parts, questions emerge on whether tech preparations will stall.

Less Than Half of Trade Reports Match Under EMIR

Data from Esma shows that just 40% of swaps trade reports match under two-sided reporting regime.

Digital Asset and Isda Create Rosetta Stone for Derivatives Smart Contracts

The event specification module will allow for a common DAML library that references machine-executable trade lifecycle events.

Vendors Prep for Initial Margin Big Bang

Tech providers are emerging from all corners as the final phases of initial margin rules closes in, which are expected to capture over 1,000 buy-side and sell-side firms over the next 18 months.

Isda Forges Tech Alliance Ahead of Initial Margin Deadlines

Isda joins forces with AcadiaSoft as the industry prepares for the final phases of the initial margin deadlines.

Tech Releases Surge Ahead of Initial Margin Deadlines

The final phases of initial margin rules are expected to capture over the next two years more than 1,000 buy-side and sell-side firms, which technology providers see as potential customers.

NEX Partners with Capitolis for FX Novation

NEX will provide connectivity to the Capitolis novation platform through NEX Infinity.

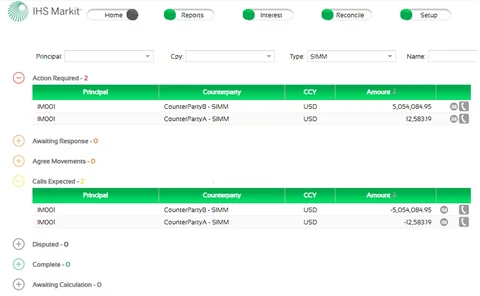

IHS Markit Unveils Initial Margin Calculation Service to Aid ISDA Margin Rule Compliance

The new service will help firms struggling with the complex calculation requirements resulting from the implementation of new initial margin calculation rules by ISDA.

Waters 25: A Look Back on the Last Two Decades

Waters examines some of the most important events in financial technology of the past 25 years.

Isda Launches First Digital Version of CDM

The electronic blueprint sets out a standardized framework for the derivatives trading lifecycle.

Isda Seeks to Standardize Derivatives Tech with REGnosys Partnership

Isda is hoping that the CDM will bring increased automation and efficiency to the derivatives market, and has tapped a fintech startup, REGnosys, to lead the project.

Derivatives Market Prepares for Emerging Tech Implementation

2018 is the year when large numbers of participants in the derivatives market expect to see emerging technologies being integrated into their existing technology ecosystems

Technology Takes Aim at Post-Trade Black Holes

The influence of regulation and new technology is prompting a hard look at how post-trade processes can be improved, and perhaps even replaced entirely.

The Post-Trade Reshuffle

The European Commission and the wider industry are turning their eyes to post-trade practices

Regulatory Forbearance May Not Be Forthcoming for VM Rule Changes

A last-ditch plea to regulators to take a lenient approach once the variation margin requirements come into effect may fall on deaf ears.

Variation Margin Requirements: The New Big Bang

On March 1 this year, a new set of requirements for variation margins on derivatives trades take effect that will affect nearly all market participants across both cleared and non-cleared derivatives. In the run-up to the deadline, John Brazier finds…