Identifiers

Open and Shut (Anything But)

It’s a heady time for those developing data standards, but Jamie Hyman says standards leaders need to agree about what “open” means, or they risk getting bogged down in semantics.

Standards Leaders Set Sights on Upper-Level Ontology for Industry

TC 68 chair sets 2020 goal for industry-wide upper-level semantic ontology.

ISIN and LEI Mapping Project Kicks Off

The initiative's first file includes more than 3.2 million ISIN-to-LEI records across roughly 25,000 unique LEIs.

LEI Issuance Flirts with Real Time

RapidLEI launches API access, shaving additional seconds off LEI turnaround.

Untapped Potential:The Road to Semantic Heaven

There is a movement underway to establish universal standards and the semantic ontologies that make them sing. As the industry approaches semantic utopia, questions remain about what steps need to be taken to get there and whether all the work will be…

Kaizen Launches Regulatory Reporting Training

The course focuses on Mifid II regulatory reporting and breaks down reference data rules that remain roadblocks for firms.

Semantics’ Seminal Moment

Data experts testify that right now, the financial services industry is uniquely positioned for semantics breakthroughs that will revolutionize the way data is managed, leading to unprecedented payoffs.

Identitii Preps APAC Expansion to Grow Payments Data Blockchain

The vendor will use the A$11 million raised from its recent IPO to further develop its platform and experiment with additional use cases for its technology.

ANNA Takes on Benchmark Challenges

The ANNA Benchmark Task Force aims to collaborate with benchmark administrators for clarity of regulatory and ISIN requirements.

DSB Announces New Services, Fee Discounts for 2019

DSB’s planned service improvements and operational cost savings that will result in rebates for users in the 2019 fee year and lower fees in 2020 and 2021.

Algomi Pivots Offering Away from Honeycomb to Alfa

Usman Khan sits down with WatersTechnology to discuss how the vendor will look to change course in 2019 and focus on the development of the Alfa platform.

ISINs and LEIs Link Up To Increase Transparency And Manage Risk

ANNA and GLEIF partner on a new initiative linking ISIN and LEI standards to better understand cross-entity exposures and dependencies.

Additional ISIN Use Cases in the Works

A DSB consultation shows an appetite for expanding identifiers for OTC derivatives.

Illuminated Data: SFTR May Reach Too Far

While waiting for the regulators’ final word on SFTR’s technical specifications, SFT market participants and counterparties are planning their compliance strategies amid concern that the regulation goes too far in its goal to bring shadow banking into…

Bad Blood: Regulators Lose Patience with Mifid II’s Dirty Data

Problems and bad practices continue to plague Europe's vision of a new transparency regime. An inside look.

Time's Up: Esma Sticks to the Schedule for Mifid II LEI Compliance

Esma’s ‘No LEI, No Trade’ policy gets real after the official end of a grace period on Mifid II’s LEI requirement, while at the same time Hong Kong regulators have introduced a new LEI mandate to boost identifier use in the region. Jamie Hyman and Wei…

TOFIS Panel: Data Linkages Pose Key Challenges to Alt Data Use

Max Bowie reports from Toronto on Canadian firms' opinions of the challenges associated with using alternative data.

Best Reference Data Provider: S&P Global Market Intelligence

IMD/IRD Awards 2018

Best Reference Data Initiative: SIX

IMD/IRD Awards 2018

Best Market Data Provider (Exchange): London Stock Exchange

IMD/IRD Awards 2018

APAs Under Pressure as Esma Cracks Down on Data Tangle

Reporting platforms told by regulator to substantially improve quality of publicly reported data.

Hong Kong Regulators Propose LEI Mandate

HKMA and SFC would stagger the implementation dates for different reporting entities.

Europe’s Mifid Monster Lurches to Life

January 3 went smoothly for many, but the launch of Europe's far-reaching reform package wasn't without problems.

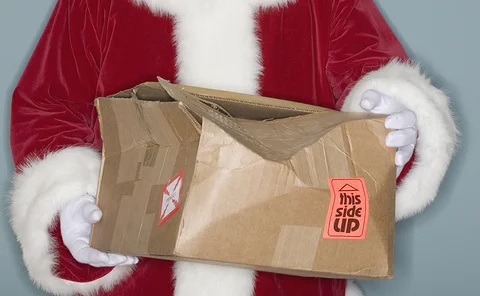

Esma’s LEI Xmas Extension: Last-Minute Gift or Lump of Coal?

Jamie Hyman talks with an LEI issuer, advocate and end-user about how Esma’s LEI grace period will impact operations during the first half of 2018.