Distributed ledger

Standard Chartered goes from spectator to player in digital asset game

The bank’s digital assets custody offering is underpinned by an open API and modular infrastructure, allowing it to potentially add a secondary back-end system provider.

Déjà vu for common domain model

Piecemeal progress on ambitious derivatives data standard raises questions over business case

Once a blockchain cheerleader, Axoni changes its playbook

The fintech, whose origins can be traced back to the genesis of capital markets’ complicated flirtation with DLT, has largely ditched the tech as the foundation of its data synchronization offering, opting for more familiar territory.

Waters Wrap: The changing definition and perception of blockchain

Anthony says that questions of definition and perception are killing DLT projects in the capital markets—oh, and a lack of proven implementations.

Waters Wavelength Podcast: Deutsche Bank’s Boon-Hiong Chan

Boon-Hiong Chan from Deutsche Bank joins the podcast to talk about blockchain interoperability.

Ace high or busted flush? Digital Asset’s mixed fortunes mirror DLT adversity

The vendor hoped to remodel post-trade using blockchain technology—and it still might—but its bumpy progress raises questions over the future of DLT in finance.

Zeros and ones: Industry contemplates T+0 as the next step

With the North American transition to T+1 settlement complete, same-day settlement could be the next goalpost set, though skeptics are many.

Deutsche Bank works on standardized protocols for asset tokenization

The bank is looking at its role as an asset servicer to ensure the safety of tokenized assets and investor protection. It plans to have a limited prototype by November.

Why recent failures are a catalyst for DLT’s success

Deutsche Bank’s Mathew Kathayanat and Jie Yi Lee argue that DLT's high-profile failures don't mean the technology is dead. Now that the hype has died down, the path is cleared for more measured decisions about DLT’s applications.

European firms prime for lopsided settlement in North America and at home

With T+1 imminent in North America and increasingly likely to traverse the Atlantic, operations and trading professionals in Europe are fighting on two fronts.

Native digital assets—a Kodak moment for financial services

Ian Hunt argues that ignoring a new business model for investment products, assets, transactions and asset servicing could sentence financial firms to the same fate as the fallen film photography giant.

JP Morgan DLT exec: Settlement rails needed for digital bonds to gain traction

At an Afme conference, Scott Lucas, head of markets DLT for JP Morgan, noted DLT’s progress in the bond space. Others said the tech has a long way to go before wider adoption.

Waters Wrap: T+1 and too many proposals

Anthony believes that there’s a growing chasm emerging between regulators, senior business execs, and technologists—which is especially evident when it comes to the T+1 debate.

Alliances and experiments: Trading firms get innovative in 2023

Rebecca offers a recap of the year's most notable technology use-cases led by sell-side and buy-side institutions.

Banks find intriguing ‘data play’ via tokenization efforts

Tokenization is no longer just a peculiarity of the crypto world, as execs from global custodian banks discuss their firms’ tokenization and digital assets strategies.

Waters Wrap: As quantum’s skeptics grow in number, believers need better messaging

As you explore ways to use genAI, do you benefit from having ML and NLP experts on staff who have followed AI evolution for years? Anthony thinks that’s an important question when talking about quantum exploration.

New crypto Isins seen as ‘really important’ step for TradFi adoption

Execs at TP Icap and Societe Generale say the identifier removes a major barrier for crypto acceptance.

ASX, SGX earnings driven by diversified revenue

After the Chess disaster, ASX focuses on rebuilding confidence, while SGX continues investing in its derivatives business. Meanwhile, HKEx mulls data play.

Institutions see everything to play for in UK’s DLT sandbox

Industry welcomes flexible issuance limits, but rues derivatives’ exclusion as a missed opportunity.

Waters Wavelength Podcast: Broadridge’s Tyler Derr

Broadridge’s CTO Tyler Derr joins the podcast to talk about interoperability, blockchain, and other emerging tech.

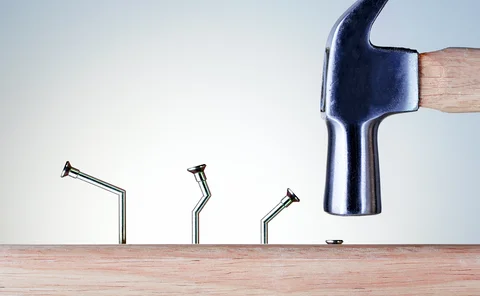

Waters Wrap: Blockchain—let’s put the hammer back in the box

With the ASX Chess DLT failure and users ignoring DTCC’s DLT option for its Trade Information Warehouse, Anthony wonders what it will take for the industry to stop touting this buzzword for non-specialized needs.