Dark pool

'Next Act: A Profile of Euronext's Alain Courbebaisse

The last decade has seen Euronext chewed up and spun out following a series of mergers & acquisitions. Once again independent, Courbebaisse is writing the exchange’s IT roadmap.

Wavelength Podcast Episode 162: IEX on the Transaction Fee Pilot

IEX’s John Ramsay joins to talk about the SEC’s proposed Transaction Fee Pilot and why he thinks it should move forward.

NYSE President Sees Tech as Key to Big Board's Next Evolution

A look at the massive tech projects (and legal battles) underway at the NYSE, which are being led by Stacey Cunningham.

Acquisitive Exchanges Find Dealmaking is Only Half the Battle

While the large-scale exchange mergers of yesteryear may be over for now, regional bourses are still finding themselves in the M&A crosshairs. Yet for those operators that pick up smaller rivals, technology and data integration often prove to be trickier…

Challenging US Exchanges Will be Uphill Battle for MEMX, Experts Warn

An industry initiative to start a new US exchange promises much, but it may struggle to deliver without a clearer purpose.

Lingering Questions Remain over Mifid II

Nearly one year on from the fundamental changes to Europe’s trading rulebook brought about by Mifid II, its overall impact is still unclear. Although experts talk of greater transparency in the markets, it’s had its share of issues, some of which are…

The Day the Data Stood Still

With the UK preparing to leave the EU in March, regulators have a limited amount of time to figure out how to keep the flow of information going between each other post-Brexit—and the window is closing.

Waters 25: A Look Back on the Last Two Decades

Waters examines some of the most important events in financial technology of the past 25 years.

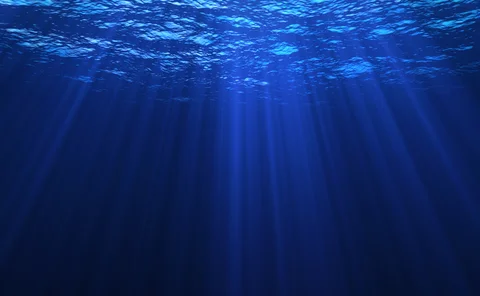

Under the Water: How Mifid II's Dark Caps Have Changed Trading

The story of how the double volume cap began is just as important as what's happened in 2018.

Dark Trading Caps Not Responsible for Periodic Auction Growth, Study Finds

FCA report find that growth in periodic auction trading is not a result of dark-trading bans.

For Systematic Internalizers, Volumes Only Tell Half the Story

Identifying what constitutes true trading activity and addressable liquidity is key to analyzing the success of market reform, experts say.

March 2018: Regulatory Watchdogs Show Their Teeth

After some questioned ESMA's resolve, the regulator is stepping up its enforcement efforts. Max reviews how ESMA wants market participants to know that its bite can be worse than its bark.

Light at the End of the Tunnel, But Will Mifid Dark Pool Rules Add Up?

Esma has released the first figures to support Mifid II’s caps on the percentage of equities trading that can be transacted on dark pools. However, critics warn that although the delay has given Esma more time to validate data and clean up queries, the…

After Delays, Esma Publishes Double Volume Cap Data

European regulator sends a message to the market that Mifid II will be enforced with this data release, experts say.

New Dawn in Europe as Mifid II Goes Live

Updated trading rules to have significant impact across all asset classes.

Best of 2017: The Top Trends

John takes a look at some of 2017's key trends, including regulation, cybersecurity and artificial intelligence.

Peeling Back European Regulations in 2018: What to Expect Next Year

Waters runs through the key facts you need to know about Mifid II, GDPR, BMR and Brexit.

All Things Are Just Dandy in the Eurozone

The tone at this year's Esma conference was a little too positive when it came to Mifid II says John.

Mifid Gears Grind into Motion as Systematic Internalizers Emerge

Market codes release shows over a dozen new entities registered in activity ramp-up

Liquidnet Enhances Virtual High Touch Suite Ahead of New Block Trading Rules

Latest enhancement to VHT suite to allow buy side to uncover hidden large-in-scale liquidity for European equities

Liquidnet Unveils Tool to Help Capture Post-Block Event Opportunities

The offering adds an additional 19% of volume to the original block execution and will absorb 9 out of every 10 blocks that appear in the minute following the initial block, according to Liquidnet.

"Arbitrary" Dark Pool Caps Leading to Increase in Block Trading and Innovation

Innovation and large-in-scale trading are set to be given a boost as the industry seeks ways to combat the dark pool double volume caps under Mifid II.

The Skinny on Euronext’s New Pan-European Dark Pool

Euronext speaks to WatersTechnology about its soon-to-be unveiled MTF for block trading that it claims “bridges the gap between human trading and electronic execution.”

Euronext Discusses its New Pan-European Dark Pool

WatersTechnology speaks with Euronext’s Danielle Mensah and reveals details of the exchange’s new “proactive” MTF for equities block trading, ahead of its official launch in mid-2017.