API

Eliminating the human touch: Examining RBC’s tech infrastructure evolution

The Canadian bank’s tech infrastructure unit is using Kubernetes as it looks to become a “truly end-to-end digital enterprise.”

People Moves: Tradeweb, Rimes, CME, LiquidityBook, and more

A look at some of the key people moves from this week, including Renaud Larzilliere (pictured), who joins Rimes as COO.

One view to rule them all: Buy side firms seek to unify their data

Asset management firms still struggle to consolidate their data so that it speaks the same language across different business lines. Some new SaaS-based investment management vendors are aiming to solve this.

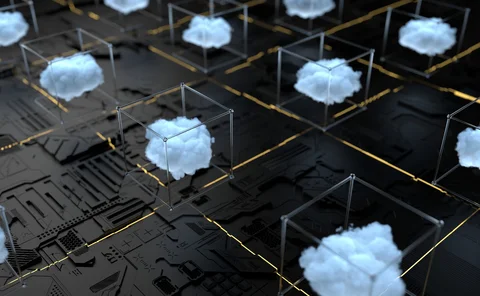

Waters Wrap: Data ownership & storm clouds brewing

Thanks to technological advancement, firms are finding new ways to monetize data. While the question of “who owns the data” was never a pressing one in the past, Anthony says that there are reasons to believe that will soon change.

People Moves: Digital Asset, Coalition Greenwich, NZX, Symphony, and more

A look at some of the key "people moves" from this week, including J. Christopher Giancarlo (pictured), who joins the board of directors of Digital Asset.

Waters Wrap: Mid-tier market data providers look to reinvent themselves

Anthony loves when his opinions spark debate. Following responses to a recent column on consolidation among mid-market data technology vendors, he provides something of a case study, which looks at how Exegy is evolving after its acquisition of Vela.

Waters Wrap: Tech procurement, hospitality & how cloud has changed the game

Because it’s easier to switch tech providers, and because the pandemic is helping to push firms to want tools delivered as a service, and because of new rules, and because of mounting challenges from startup fintech companies, Anthony says that incumbent…

The bank, the vendor, the turrets and the golf day

After DBS switched suppliers, a row broke out, raising questions about entertainment and influence

2021 saw market data’s quiet revolution

This year, the SEC pulled the trigger on competing consolidated tapes and a new market data governance plan. In 2022, we will know if some of it can go ahead, or remain stymied by legal battles.

Waters Wrap: The biggest disruptors facing the capital markets as we head into 2022

In Anthony’s mind, eight topics will dominate the headlines in the New Year. They are…

Slow burn to a big bang: How the new wave of tech is changing market data platforms

For decades, market data platforms have been critical components of financial firms’ trading infrastructures. But with changing user needs and emerging technologies gaining ground, will the platforms of the past be replaced by upstart challengers—or can…

Disrupting data delivery: AWS Data Exchange gains ground with addition of FactSet content

Leveraging AWS’s presence on Wall Street, Data Exchange has the potential to shake up traditional financial data delivery and contracts, if it can add relevant content and overcome challenges like real-time streaming and connectivity in the cloud.

This Week: T+1; FlexTrade/TradeFeedr; SimCorp/Snowflake; and more

A summary of some of the past week's financial technology news.

FactSet EMS adds fixed-income trading capabilities

Portware is already integrated with fixed-income electronic trading platform Trumid, as well as Tradeweb, MarketAxess, and Bloomberg.

This Week: Cboe-Neo, Aviva-Macrobond, Iress, BNY Mellon, Options, MT Newswires-Bloomberg, and more

A summary of some of the past week’s financial technology news.

In pursuit of API-ness: Rise of API interfaces hints at data platforms of the future

Nasdaq’s new Data Fabric managed data infrastructure service presents an opportunity for firms to outsource many elements of their market data platforms to the exchange. But making it possible—and also driving innovations at other data providers designed…

Patchy data thwarts consolidated tape hopefuls in Europe

Vendors grapple with unstandardized data reporting and data gaps in their push to develop a consolidated tape, as the EU prepares to unveil its latest legislative plans.

SGX to roll out new market data licensing, usage tool

The exchange is partnering with DataBP to offer an online portal that includes customer-facing tools and back-office automation.

Waters Wrap: On cloud migrations and VCRs

Financial services firms are increasingly embracing public cloud offerings, but there have been stumbles along the way, including around scalability, throttling, and a lack of true multi-cloud connectedness. These are lessons that must be learned if…

FIS modernizes through modularity

The vendor has been in the process of overhauling its entire tech estate for almost seven years, with the aim of offering modular, flexible services.

Interoperability: Banks struggle with just how much they want for flagship platforms

For all the talk of interoperability within the capital markets, Wei-Shen wonders just how far firms are willing to go.

Bank of Montreal begins 2nd phase of cloud migration and development strategy

Similar to its competitors, BMO wants the future development of financial services tools to be cloud-native. The bank expects 30% of workflows to be moved to the cloud within three years.

Waters Wrap: Examining Digital Asset’s DLT strategy (and its broader implications)

Digital Asset has slowly expanded its influence with exchanges in the APAC region, and this year has made additional inroads in the US and Europe. Anthony examines the company's wins and losses over the last seven years.

Murky road ahead for consolidated tape plan administrator in the US

The business unit of the new equities data plan could revolutionize pricing and accessibility in the public feeds of NMS data, say hopefuls to the role, but litigation and lack of clarity obscure the path forward.