Analysis

LSEG: Cloud Enables Better Visualization Tools

Advances made in the exchange group's cloud program have filtered down to help improve its data offerings.

AI and Cloud Remove Barriers to Entry for Real-Time Intraday Liquidity

As increased regulatory reporting obligations add to the pressure financial institutions are under to manage intraday liquidity, centralizing siloed legacy systems into a single automated solution can offer an enterprise-wide, real-time view of liquidity…

SEC Taps MayStreet to Replace Thesys as Midas Operator

MayStreet has taken over the role of market data provider to the SEC's Midas data consolidationand market analysis platform.

AI’s Next Phase – Thriving Through Implementation

Many in financial services are trialing artificial intelligence (AI) applications, with projects increasingly sophisticated in methodology and ambition. WatersTechnology, in partnership with SmartStream, recently convened a Chatham House-style discussion…

Bloomberg Advances on Cloud Data Strategy

The global data giant is working with clients to deploy its data services from the three main cloud providers.

People Moves: MarketAxess, OpenDoor, Capitolis, FSB, CloudMargin, Fenergo, CLS

A look at some recent key people moves, including Kat Tatochenko (pictured), who joins MarketAxess.

Banks Embrace the Use of Synthetic Data

Banks have long been using synthetic data to validate solutions, but tech advancements and regulatory pressure have established this practice as a crucial step in the development and testing of technologies.

Universal-Investment Explores AI to Develop ESG Services

The administrator is looking at how artificial intelligence can be used to extract online sentiment and create customized alternative data services to attract clients.

Bank of England’s Ambitious Look at Regulatory Reporting

As the regulator looks at new ways to handle data, there are still a lot of paths to consider.

Not Random, and Not a Forest: Black-Box ML Turns White

Bayesian analysis can replace random forest with a single, powerful tree, writes UBS’s Giuseppe Nuti.

SEC’s Redfearn: US-Style Consolidated Tapes Won’t Solve Trading Data Needs

As European market participants bemoan the lack of a consolidated tape, a senior SEC executive debunks the idea that a pan-European tape, similar to the US, will resolve issues around data access and costs.

Geopolitical Risk Data Moves from Foreign Intelligence to Fund Management

As nations and markets become increasingly interconnected, geopolitical risk has become top of mind for portfolio managers.

ParFX Plans Push into Derivatives

The trading platform has snapped up a MIC code as it ponders whether the growing market segment needs a ParFX model.

Data Standardization Remains Top ESG Roadblock

As asset managers seek to incorporate ESG factors into their portfolios, they are facing challenges—particularly around data consistency. Some say custodians could offer solutions.

M Science Rolls Out Weather Data, Visualization Tools for Portfolio Managers

M Data Viz provides granular data on weather events by state and region to support investment processes.

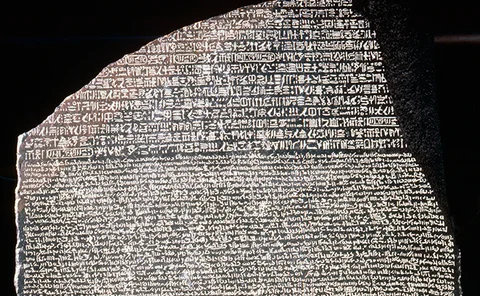

Firms Carve Rosetta Stones for Non-English AI Surveillance

Development of machine learning and natural-language processing is now turning to languages other than English to keep a better eye on traders and the market. But how easy is it to teach a machine a new tongue?

December 2018: Getting There

Data management is more about striving than finalizing.

FlexTrade Taps Corvil for Network Analytics

The technology layer is designed to profile FlexTrade's network infrastructure to detect and analyze performance issues.

Deep Learning: The Evolution is Here

Advancements in AI have led to new ways for firms to generate alpha and better serve clients. The next great evolution in the space could come in the form of deep learning. WatersTechnology speaks with data scientists at banks, asset managers and vendors…

FCA: Bad Tech Leads to Cyberattacks

UK regulator warns of firms' inability to manage system failures and cyber attacks as reports in incidents are on the rise.

Buttigieg to Help Esma Shape Data Policy

Director of the Maltese regulator's securities and markets supervision unit is named chair of Esma's data standing committee

Alt-Data Difficulties Challenge Largest Asset Managers

A new study finds that while large asset managers are investing in big data analytics and alternative data, it’s a fraught process.

Refinitiv’s QA Direct Platform Commits to the Cloud

The quantitative analytics platform launch is in partnership with Microsoft Azure.