Algo

Machine Learning in the Capital Markets 2020: ML Spreads During Pandemic

WatersTechnology looks at how 10 different firms are embedding machine learning algorithms into their platforms and tools.

The ABCs of NLP: How Trading Firms Used NLP to Navigate 2020

This year, natural language processing came to the fore in capital markets, helping firms of all kinds parse huge, unstructured datasets.

Machine Learning will Create New Sales Bots on Trading Desks

Technologists are working to automate indications of interest from trading desks, according to UBS’s head of machine learning.

Waters Wrap: S&P-IHS Markit and the Land of Giants (Also, More on AML Tech)

Anthony provides some of his initial questions and thoughts following the S&P-IHS Markit deal. He also takes a second look at AML technology after getting some sage feedback.

Waters Wrap: Machine-Learning Models Suffer from Covid (And Exchanges in the Cloud, Pt. 2)

Anthony says that while machine-learning models have been hit-and-miss during the pandemic, NLP is taking on greater importance. He also looks at how exchanges are looking to move their core matching engines to the cloud.

Industry Still at Odds Over Use Case for an EU Consolidated Tape

Market participants say they want a high-quality, centralized source of market data for EU equities. But who and what is it actually for?

QuantConnect Brings Low-Code Principles to Quant Finance

Later this year the vendor is looking to allow users to clip together various components of an algorithmic trading strategy, making it easier for users with limited programming skills to build their own trading strategies.

Science Friction: Some Tire of Waiting for Quantum’s Leap

Use cases for quantum computing are piling up—from CVA to VAR. But so are the obstacles

IEX Makes Expansion Bid as New Limit Order is Approved

The Investors Exchange is now looking to propose a second new order type for NBBO non-mid liquidity.

Waters Wrap: Causal Machine Learning Represents Next Evolution of AI (Plus ESG & Innovation Issues)

Anthony looks at an interesting project using causal inference by IBM and Refinitiv, and what this latest evolution of machine learning could mean for innovation in the capital markets in the future.

Data Poisoning: An Emerging Threat for Machine Learning Adoption

Experts from IBM and Bank of China say they're on the lookout for this emerging threat, as machine learning gains in popularity.

Low-Code Movement Gains Converts, but Skeptics Remain

What if you could create your ideal, fully-functional application without writing a single line of code? With low-code and no-code platforms, you can—with a catch … or two, or three, or four.

How Schroders is Bypassing the Noise in News Sentiment to Identify Credit Risk

The UK asset manager is using Owlin's media analytics platform to identify negative news sentiment linked to credit risk.

This Week: SGX/Cassini, UBS/GitLab, QuantConnect & Snowflake

A look at some of the past week's financial technology news.

Eventus Systems to Add ML-Driven Trader Profile Feature to Validus

The new functionality will help to give context to market manipulation alerts.

Waters Wrap: Unintended Consequences & AI Regulation (And Mobile Trading Reg & BERT NLP)

Due to the pandemic and rapid advancements in the fields of AI and mobile technology, regulators in the US and Europe have unique challenges on their hands.

EU's AI Regulations Could Lay Blame With CTO

Jo wonders if the EC's approach to regulating AI could adapt existing liability laws—with implications for individuals.

Vaccine Tracking Data—The Next Big Alt Dataset

Investment firms and vendors are searching for signals in healthcare and pharmaceutical data in a bid to get a leg up on a Covid-19 vaccine.

Quants Use Nowcasting As Covid Crystal Ball

Experts from UBS, Unigestion, MIT and QuantConnect discuss the need for nowcasting, and what the alt data boom has made possible in trying to navigate today’s crisis.

Nowcasting Provides Macro Insights, say Active Managers

Using alternative data to understand macroeconomic conditions in almost real time can give investment teams an edge.

MSCI Uses NLP to Measure Company Innovation

The global market index firm is quantifying innovative investments and mapping them to a company’s performance.

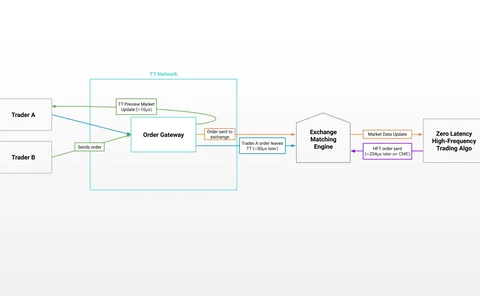

Trading Technologies Unveils New Futures Market Data Feed

As the fight over market data fees in the futures market heats up, the Chicago-based trading platform provider is rolling out a new platform that provides a free view of market order flow for TT platform users.

Machine Learning: A Math Problem or a Workflow Problem?

For good reason, machine learning has a highly technical focus. But less talked-about challenges lie in managing the human capital and workflows associated with the tech.

AI Can Drive Reconciliations Efficiency In Period of Increased Volume

As the coronavirus drives trading volumes, post-trade processing is increasingly an area of operational risk, and firms should consider automation, analyst says.