Exchange Data

Four years of academic study on HFT yields complicated results

A transatlantic group of researchers has examined a treasure trove of market data to see whether or not high-frequency trading is a necessary component of today’s market structure. The answer is largely ‘yes,’ but with caveats.

Waters Wavelength Podcast: Episode 236 (Market data, ESG, and interoperability)

Wei-Shen and Tony talk about WatersTech’s three biggest stories of the week.

One step closer: How exchanges are seeking tighter relationships with clients

Increasingly, exchanges are trying to get closer to their customers, in a bid to better understand how they use market data. This move may come at the expense of data vendors that are being gradually squeezed out of the exchange-client relationship.

Despite client concerns, LSE’s new Sedol fees take hold

Under the new fee policy, some of the largest users of the LSE’s identifier codes could see their Sedol spend more than double, though the exchange says the “vast majority” of clients will see no increase.

Waters Wavelength Podcast: Asian exchanges

Keiren Harris, a strategy-based market data consultant and founder of DataCompliance, joins the podcast to talk about exchanges in Asia and their data strategies.

This Week: Refinitiv; State Street/BlackRock; SteelEye; SimCorp; FEX Global/TT

A summary of some of the past week’s financial technology news.

TRG Screen acquires Jordan & Jordan’s market data compliance & reporting unit

TRG will combine J&J's six-year-old MDR managed service for data reporting with its own similar ADS declarations service.

As ASX preps Chess replacement testing phase, other data & cloud projects progress

Testing on the new DLT-based platform will begin in July. The Aussie exchange is also making progress on its DataSphere project and has addressed ASX Trade after an outage last year, according to the company’s CEO.

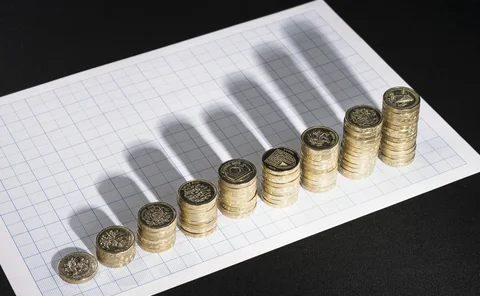

Broker data policies stoke fears of ‘exchange-style’ fees and audits

Interdealer brokers are looking enviously at the way exchanges have been able to grow data revenues, providing a stable stream of profits as other business lines have declined. But following the exchange model has its own challenges.

SEC’s Market Data Infrastructure Rule Not Easily Said or Done

The finalized equities market infrastructure reforms will make a difference, but some market participants are calling for additional clarity.

BMLL Now Has 5 Years of Order Book Data Available

Quants and data scientists can now access five years of Level 3 data through the vendor's Data Lab platform for use in alpha generation.

Waters Wrap: On Refinitiv and Old Rivalries (And FIGI & Data Governance)

Anthony explores some of the questions raised by Refinitiv's plan to move away from Eikon and Thomson One. He also looks at data governance trends, and asks why the FIGI is having such a tough time gaining acceptance.

ASX Presses Forward with DataSphere Buildout

The initiative's aim is to capture more of the exchange's internal data to commercialize that useful information for the investment community.

Exchanges, SEC At Odds Over Odd Lots

Industry insiders warn that the regulator’s attempts to modernize equities data by redefining trading lots will fall short of the mark if odd lot orders remain unprotected.

Multicast: The ‘Holy Grail’ for Getting Exchanges to the Cloud

Cloud providers are hunting for a way to bring multicasting to the cloud for low-latency market data distribution, unlocking the gateway for traditional exchanges to shift core infrastructure to the cloud without negatively impacting high-speed trading.

BT Radianz to Add Chinese Alt Datafeeds

Initially, BT Radianz is looking for datasets that could help forecast consumer demand, such as sentiment, consumption, and transactional data.

Weighing the Benefits: Hardware Vs Software

In the pursuit of new ways to eliminate latency from the market data distribution and trading processes, vendors have invested in hardware-acceleration technologies, such as FPGAs. But with commodity chips now giving specialist hardware a run for its…

TREP’s Tipping Point? An Examination of Refinitiv’s Market Data Platform

Refinitiv—and by extension, TREP—has experienced a fair amount of disruption over the last two years. Competitors are lining up to cut into the platform's market share.

TRG Screen Integrates PEAR Policy Database After Axon Acquisition

The integration of PEAR, acquired last year, is a further step towards integrating the vendor's key data inventory management platforms, FITS and InfoMatch.

EU Consolidated Tape: Support Wanes With Lack of Answers

With regulators slow to answer industry questions relating to how a CT should be built and what it's for, development has slowed.

MEMX Builds Out Infrastructure as it Waits on Regulatory Approval

The exchange’s CEO and COO discuss its matching engine, Intel partnership, cloud strategy and plans for the future.

LSEG Building New Algo-Testing Tool

The exchange group is developing new regtech products while looking to move these offerings to the cloud in 2020.

Brokers Tackle Pro v. Non-Pro Data Cost & Compliance Challenges

Max Bowie digs deep into how firms are making sure they classify data consumers correctly to avoid paying unnecessary fees.