Exchanges & Trading Venues

Waters Wrap: Interop trends that will shape 2021 projects (And silencing the pit)

Anthony brings in some guests to give predictions about what interoperability will look like over the next 12 months and what firms need to start preparing for today.

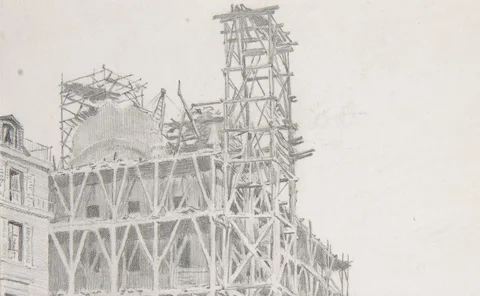

LME overhauls tech, data stack amid calls for trading floor closure

The London-based commodities exchange has embarked on an ambitious technology and data infrastructure modernization strategy as it takes steps to close its open-outcry floor.

HKEX targets company disclosure gaps with artificial intelligence

The system monitors annual reports for issuer compliance with listing rules, speeding up a formerly manual job.

Not so Fast: SEC’s SIP Rule Speeds Ahead, But Faces Bumpy Road

Jo is skeptical that the SEC’s finalized market data infrastructure rule will make the public market data feeds faster.

SEC’s Market Data Infrastructure Rule Not Easily Said or Done

The finalized equities market infrastructure reforms will make a difference, but some market participants are calling for additional clarity.

Aquis Slashes 'Jitter' in Cloud Project

In a recent proof-of-concept with AWS and SGX, Aquis demonstrated significant jitter reduction.

EU Regulators Spill More Ink Tackling Market Data Costs

The latest consultation on the market data obligations under Mifid II looks to provide better, cheaper, and more uniform access to market data. But will it be enough to standardize policies?

Nasdaq, HKEx: Blockchain’s Disruptive Potential Overstated

Distributed ledger technology won’t replace existing exchange infrastructure despite potential for smaller use cases, say CEOs.

This Week: ASIC/RBA, TSE, Schroders/SteelEye, HKEx, Talos, and more

A look at some of the past week’s financial technology news.

ASX Presses Forward with DataSphere Buildout

The initiative's aim is to capture more of the exchange's internal data to commercialize that useful information for the investment community.

CME Reg Reporting Competitors Vie to Fill the Void Ahead of Withdrawal

With over five months to go until CME unwinds its regulatory reporting businesses, competing firms are pushing to fill the service gaps and grab a slice of the market share.

Trading Venues Face Resilience Test in Covid-19 Pandemic

Software testing and monitoring keeps market infrastructure a step ahead amid market volatility.

CME’s Reg Reporting Rollback: A Sign of What’s to Come

Sources say the exchange group’s scaleback is a result of pricing wars, unsustainable business models, and the realities of commercially supporting a regulatory reporting business.

R3: Digital Asset Exchanges Will Expand Range of Traded Assets

The development of digital asset exchanges could disrupt capital markets by introducing new asset types and extending trading hours.

CME Group to Scale Back Regulatory Reporting Business

The exchange group is closing several of its regulatory reporting businesses following a review finding they no longer align with its strategic direction.

MEMX Postpones Launch Due to Coronavirus

CEO Jonathan Kellner announced on April 17 that the exchange would have to push back its official launch date, as well as delay platform testing and member certification until later this year.

Nasdaq, Cboe Fix Feeds Hit by Options Overload

Recent market volatility overwhelmed the Nasdaq BX and Cboe market depth feeds with so much activity that the exchanges did not have enough physical numbers to accurately represent it.

This Week: Philippine Stock Exchange, IBM, Cboe, Esma & More

A summary of some of the past week’s financial technology news.

MEMX Builds Out Infrastructure as it Waits on Regulatory Approval

The exchange’s CEO and COO discuss its matching engine, Intel partnership, cloud strategy and plans for the future.

Wavelength Podcast Ep. 175: Tradeweb's Billy Hult

Duncan Wood interviews Tradeweb's Billy Hult about the changing trading landscape.

OKEx Expands Crypto Derivatives Offering

The Malta-headquartered digital asset exchange has upgraded its trading architecture, with an eye on futures and options trading features.

As Passive Investment Drives Closing Auction Volumes, Chi-X Takes Aim

Chi-X launched MatchPoint to meet the demand for anonymous trades during the closing auction.