Benchmark Solutions

Waters Wrap: A useful use-case for blockchain? (And Broadridge’s bond play)

While not a fan of blockchain, Anthony looks at some potential use-cases for the tool in the world of capital markets. He also gives his thoughts on Broadridge’s soon-to-launch LTX platform.)

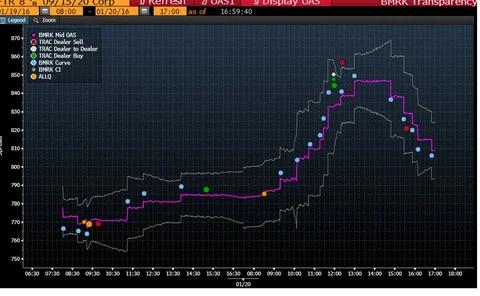

RW Baird Taps Magenta Bond Benchmarks as Bloomberg Completes BMRK Integration

The financial firm can now use the Magenta Line pricing tool more fully now Bloomberg has integrated it into its trading platforms.i

Bloomberg Integrates Magenta Line Pre-Trade Pricing into Professional Terminal

BMRK uses the Magenta Line technology acquired from Benchmark Solutions, which closed in 2013.

Opening Cross: Teenage Takeover!

I can still recall my first days at then-Risk Waters Group in 2000 as a greenhorn researcher working on Risk magazine and FX Week, trying to quickly learn new industries and lingo, while at the same time trying to hide my inexperience. One of my earliest…

Interactive Data Gets Gartland for Real-Time Evaluated Pricing Service

Interactive Data has hired industry veteran Bill Gartland as senior director of the vendor's new Continuous Evaluations service, which will provide continuously-updating prices for fixed income securities.

Ex-Tradeweb, Benchmark Solutions CEO Toffey Joins GFI

James Toffey, who founded Tradeweb and later worked with private equity firm Warburg Pincus to build short-lived fixed income pricing provider Benchmark Solutions, will head up the interdealer broker's electronic markets in cash, derivative instruments,…

Is There Life After Market Data?

The market data industry is often known for its “incestuous” nature, where many people spend their career moving among a small clique of companies. But recent industry headcount cuts have left many reevaluating their careers, while others are seeing the…

Second Time Around, Corporate Bonds Platforms Putting Interface First

Benchmark Solutions and iTB both aim to make corporate debt tools elegant as trading in the asset class incrementally goes electronic. Their interfaces illustrate two approaches, fit to purpose.

Corporate Bonds' Brave New World

With the market structure for corporate bonds in flux, Tim Bourgaize Murray finds that good ideas abound, and greater automation may bring some empowerment to the buy side. But in this fragmented market, even technology can’t completely quell the…

Who Should Pay for the New TCA?

When it came time to announce who will bear the cost of next-generation transaction cost analysis (TCA), the experts had more than one suggestion.

Benchmark Aims to Bring Pricing Transparency to Corporate Bonds

Benchmark Solutions aims to provide independent, third-party pricing to firms building their own electronically executed corporate bond trading platforms.

Analytics special report

May 2012 - sponsored by: Benchmark Solutions, Recognia, SIX Swiss Exchange, Thomson Reuters