NYSE

Waters Wavelength Ep. 309: FIA Boca

This week, Tony and Nyela discuss Nyela's week spent in Boca Raton, Florida, covering the FIA Boca conference as well as the current developments around 24/7 trading in US equity markets

Opra considers ‘dynamic load balancing’ for options market

The data distributor recently completed a challenging project to build a 96-line feed. This new endeavor could prove just as challenging (but perhaps necessary) for the industry that will use it.

IEX, MEMX spar over new exchange’s now-approved infrastructure model

As more exchanges look to operate around-the-clock venues, the disagreement has put the practices of market tech infrastructure providers under a microscope.

The Waters Cooler: Are times really a-changin?

New thinking around buy-build? Changing tides in after-hours trading? Trump is back? Lots to get to.

As NYSE moves toward overnight trading, can one ATS keep its lead?

An innovative approach to market data has helped Blue Ocean ATS become a back-end success story. But now it must contend with industry giants angling to take a piece of its pie.

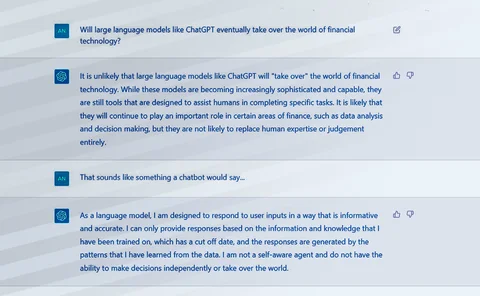

The Waters Cooler: AI tells it like it is… or does it?

A weekly round-up of stories from us and beyond. Plus, fun Scottish facts.

Industry not sold on FIGI mandate for US reg reporting

Banks’ and asset managers’ tortured relationship with Cusip numbers remains tortured, as they tell regulators to keep the taxonomy in play.

People Moves: Broadridge, IEX, DTCC, and more

A look at the past month’s people moves in the capital markets technology and data space.

The IMD Wrap: Déjà vu as exchange data industry weighs its options

Max highlights some of WatersTechnology’s recent reporting on data costs and capacity issues facing the options industry, and asks, haven’t we seen this before somewhere?

After contentious Opra upgrades, vendors brace for a faster future

Upgrades to the datafeed widely used to gauge the current market price for options contracts went into effect in February after three separate delays, which market participants say were caused by persistent bandwidth issues at some important recipients.

Blood, sweat, and tiers: how the SEC’s exchange rebates proposal could reshape US equities markets

The proposal to overhaul volume-based rebates for agency brokers may create significant shifts in liquidity, order routing, and competition. And industry practitioners are split on whether it’s for better or for worse.

Industry unsure of SEC’s new short-selling transparency rule

Does the SEC’s recent 10C-1a rule provide sufficient transparency while protecting traders’ short-sale positions from a GameStop-style backlash? The data will be key.

Waters Wavelength Podcast: Generative AI: The philosophical considerations

Steve Rubinow joins the podcast to discuss artificial intelligence and the hype cycle of generative AI.

A fully cloud-hosted exchange is coming—but for now, one piece at a time

Execs from Google, LSEG and NYSE discuss how exchanges are beginning to leverage the true potential of the cloud.

Large language models: Another AI wave has come—what could it bring?

Since the release of ChatGPT, excitement and hype have been abundant across industries for this form of generative AI. For capital markets, the wave of innovation that could result may be a few years away but it’s worth paying attention to—and being…

Consolidated tapes gain ground in 2022

Regulators in the US, UK, and EU moved to push forward market data efforts this year.

Court thwarts exchanges’ petition to head off market data threat

The DC appeals court has denied a petition to void a rule that seeks to bring competition to the US consolidated tapes.

People Moves: Deutsche Börse, Talos, Gresham, Tradefeedr, and more

A look at some of the key people moves from this week, including Shannon Johnston (pictured), who joins Deutsche Börse as chair of the supervisory board's technology committee.

Spot the difference: Why crypto data can’t be treated like traditional market data

As institutional participation in cryptocurrency markets increases, traditional data vendors and new specialist crypto data providers are taking different approaches to supplying necessary data to financial firms.

Cboe completes integrations of triple acquisition, turns focus on risk and analytics

In 2020, Cboe Global Markets acquired three businesses in rapid succession. Two years later, the tech stack integrations are complete, and the now-combined entities make up the majority of the exchange’s rebranded Risk and Market Analytics Group.

Waters Wrap: Snowflake’s cloud plans and what they mean for the interop movement

Upstart Snowflake hopes to be the global data network that brings true interoperability between data and trading platforms across the capital markets. Anthony says it’s an audacious plan, but one worth watching.