London

Microsoft exec: ‘Generative AI is completely passé. This is the year of agentic AI’

Microsoft’s Symon Garfield said that AI advancements are prompting financial services firms to change their approach to integrating AI-powered solutions.

Orchestrade resists SaaS model in favor of customer flexibility

Firms like Orchestrade are minimizing funds and banks’ risks with different approaches to risk management.

Substantive Research reveals new metrics for market data negotiations framework

The research firm will make its industry-derived project available for public consumption next month.

Data costs rose in 2024, but so did mitigation tools and strategies

Under pressure to rein in data spend at a time when prices and data usage are increasing, data managers are using a combination of established tactics and new tools to battle rising costs.

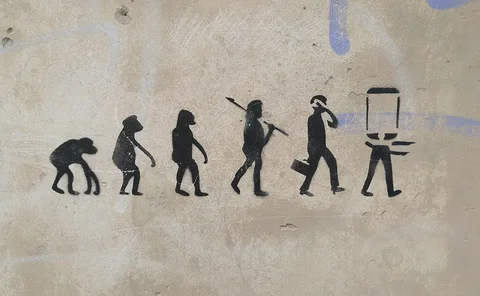

CDOs evolve from traffic cops to purveyors of rocket fuel

As firms start to recognize the inherent value of data, will CDOs—those who safeguard and control access to data—finally get the recognition they deserve?

People Moves: Wilshire, Big xyt, Liquidnet, Roko Labs, Tasksize, and more

A look at some of the past month’s people moves in the capital markets technology and data space, including Brian Rosenberg as president and CRO of Wilshire Indexes.

Tech VC funding: It’s not just about the money

The IMD Wrap: It’s been a busy year for tech and data companies seeking cash to kick-start new efforts. Max details how some are putting the fun into fundraising.

Man Group’s head of risk engineering doesn’t trust ChatGPT for managing risk

Risk managers have a duty to know how AI is being used within their firms. At a recent event, execs from Man Group and others discussed the benefits and pitfalls of AI in risk management.

The Waters Cooler: Drink wine and avoid talking to morons

UBS’ narrative alpha ML tool; SS&C fighting a ‘Frankenstein’ perception; why Citadel (and others) aren’t IPO’ing; and even more tape providers emerging. Lots to get to.

What hedge funds are missing about messaging

When a mere microsecond delay can impact the bottom line, hedge funds need high-performance technology stacks and infrastructure. Himanshu Gupta outlines four key considerations for a firm’s messaging architecture.

Bloomberg ups focus on quants, intraday strategies

The vendor hopes its OHLC Bar data product will woo new audiences among quant traders and analysts, who have previously had to painstakingly build solutions in-house.

Moral models: The ethics of data management

The IMD Wrap: You may be managing data efficiently, but are you managing it ethically? And is that something you should be concerned about? Yes, says Max, you should.

Interop after acquisitions remains daunting for buyers

Executives from a variety of vendors speaking at WFIC explained why desktop interoperability is important and why progress has been slow.

Why don’t you write a book? Several notable data professionals are doing just that

The IMD Wrap: Max talks to some data architects-turned-authors who are literally sharing volumes of knowledge.

JSE rolls out exchange data to cloud Marketplace, built with DataBP

The move—part of a broader cloud migration at the exchange—allows financial firms to connect and subscribe to JSE news, market data, and analytics via the cloud.

The IMD Wrap: Quality drivers—the sticks and carrots accelerating the data quality race

Like a Formula One Grand Prix, data management is a race that can be won or lost. And just as each race is part of a larger F1 championship that pays large sums of TV money to the winning team, winning or losing one race can contribute to winning or…

JP Morgan touts DLT, tokens for collateral management

Distributed-ledger technology could make moving non-cash collateral more efficient, said managing director Toks Oyebode during an Isda conference on Thursday.

BlackRock-Preqin: It’s the data, Cupid!

As BlackRock buys Preqin, and LSEG strikes a data deal with Dow Jones, Max notes that in data, strange bedfellows breed valuable offspring.

UK asset manager: AI in macro trading ‘very overblown’; useful for nowcasting

The managing partner of Fulcrum Asset Management said that the firm has been developing nowcasting tools that even central banks have consulted on.

Heavy lifting: Why using AI for data extraction is still no easy task

Using AI to extract data from documents and filings should be a no-brainer. But it takes a lot of brains and money to get those processes set up and running reliably and accurately.

People Moves: NorQuant, Tradition, Duco, HKEx, SimCorp, Hazeltree, Xceptor, Broadridge, and more

A look at the past month’s people moves in the capital markets technology and data space.