Waters

People Moves: Calastone, MarketAxess, Lime, Azul Systems

A look at the some of the week's key people moves, including Steve Wilcockson (pictured), who joins Azul Systems.

MarkitSERV Delays Credit Rollout for TradeServ Platform

The vendor is live with FX NDFs on the new cloud-based platform, but credit has been pushed to 2020 earliest.

New Data Needs Lead to New Data Jobs

The increasing importance of data is introducing new roles to the financial sector. Wei-Shen looks to the future.

As ESG Strategies Evolve, New Questions Are Raised

Jo says there are some basic standards that must be finalized before socially responsible investing takes off.

IHS Markit Boosts Asian Credit Liquidity Measurement with MSCI

The vendor will also expand its proxy pricing into the maturing fixed income markets outside of core regional financial centers.

Liquidnet Targets Long-Term Investors with New Business Unit

The new business unit will unify Liquidnet's last three acquisitions: Prattle, RSRCHXchange, and OTAS.

CME, Google Ally for Cloud Market Data Access

The partnership will allow existing and potential subscribers around the world to access all CME Group data via a connection to Google Cloud.

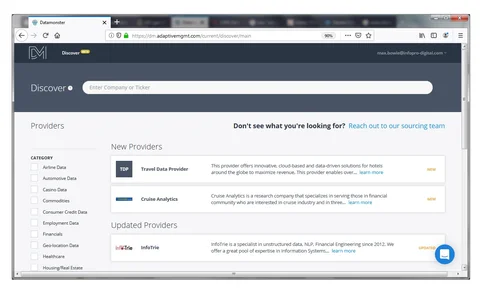

Adaptive Management Launches Free Alt Data Search Tool

Investment professionals can use Discover to find the right dataset and provider for their needs.

People Moves: Refinitiv, Apex, Connamara Systems, Ascertia

A look at some of the key "people moves" over the past week, including Renaud Oury (pictured), who joins Apex.

DTCC Explores Gatekeeper Role for DLT Networks

Post-trade company looks to stay ahead of DLT curve with plans to act as CCP for firms trading on permission-based blockchains.

Alt Data’s Mid-Life Crisis

Alternative data is maturing. But with its growth spurt comes growing pains—just ask Thasos Group. And though the market is still in its adolescence, it’s starting to face some grownup challenges.

Itiviti to Expand Regulatory Coverage, Starting with the CAT

The Swedish company is working with a third-party to build the solution, which will launch in Q4.

A Look Inside UBS's Quantitative Evidence & Data Science Team

Led by Bryan Cross (pictured), the asset manager's QED team aims to blend quant and fundamental to find unique solutions to new problems.

Bureau Van Dijk Rebuilds Risk Management Platform

Bureau Van Dijk's Compliance Catalyst has been rebuilt ahead of plans to move the platform to the cloud, as well as navigate the EU's fifth anti-money laundering directive.

TP Icap Preps African Data Package

The broker's new dataset covering the region is in response to increased client demand for data on sub-Saharan Africa, and increased investment in the region.

Old Dogs, New Tricks: Veteran Tech Execs Enjoy the Startup Life

An examination of how long-serving industry veterans are finding a home at fintech startups.

People Moves: BMLL, DriveWealth, Blockchain, GCTA

A look at some of the key "people moves" over the past week, including Howard Surloff (pictured, right), who joins Blockchain.

AI’s Next Phase – Thriving Through Implementation

Many in financial services are trialing artificial intelligence (AI) applications, with projects increasingly sophisticated in methodology and ambition. WatersTechnology, in partnership with SmartStream, recently convened a Chatham House-style discussion…

As Blockchain Evolves, Interoperability Between Vendors Could Create Challenges

During the most recent CFTC TAC meeting, members discussed interoperability issues, as well as quantum encryption concerns.