Regulation

DTCC Completes Move To CA Web From Legacy Systems

Corporate Actions Web service replaces PTS and PBS, adds instruction message capability

Contrarian Views for Startups: Come Together, Over Regs?

Anthony also discusses five random news events.

Benchmark Upheaval

MiFID II Causing Concern About Pricing Data

ESMA To Centralize Reporting Data

Regulator Launches Two Major Projects for MiFID and EMIR

ISDA Calls for Derivatives Standardization Through SEF Flexibility

Report aims to harmonize regulatory efforts at derivative market standardization.

Three Wishes For GIINs

Strapline: Industry Warehouse

Regulators Mandating Cyber-Related Technologies? Pump the Breaks

Too many accidents will lead to regulatory reform.

Confusion Still Hinders European Derivatives Reporting Transparency

One year after the start of OTC derivatives trade reporting, there are still underlying issues dogging the project.

LSEG's Bertrand Gives Update on Mifid II Preparations, Intraday Auction

LSEG plans to be Mifid II compliant by end of 2015; use 2016 to test, tweak.

ISO 20022: 'Not a Panacea'

Volante Releases New Version of Integration Solution

What's the Point of Stress Testing Without Granularity?

Anthony questions CCP stress-testing guidelines.

Standardized Stress Tests ‘Desirable' for CCPs, Fight Continues Over Granularity

CCPs discuss the merits, and concerns, around standardized stress testing.

ISE Preps for Reg SCI & New Trading Platform

Gary Kats and Boris Ilyevsky discuss Reg SCI and the new ISE trading platform

IRD's Editor on BCBS 239 Progress

Firms taking action, even as architects of the principles prove slow to offer guidance

Time To Play Ball With Data

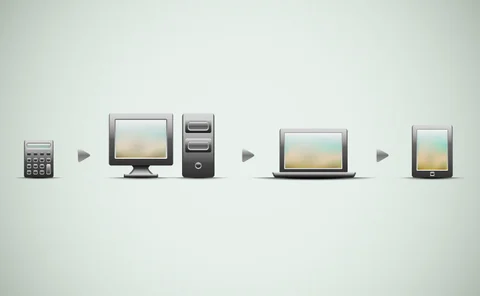

Centralization figures in several data management trends and developments

Shared Understanding

BCBS 239 risk data aggregation principles drive broader view of available data

Esma, Singaporean Regulators Signs MoU on CCPs

MoU to set the cooperation arrangements regarding Central Counterparties (CCPs).

Controlling the Flows

Enhanced Liquidity Ratios for Europe Bring Extra Burden to Firms

Fenergo Enhances Regulatory Compliance Engine

Service Available As Addition or Standalone

Sticking The Landing On BCBS 239

Readiness for risk stress tests may seem to lag, but data managers are making plans

New SEC CIO Dyson Pursues Data-Minded Goals, Old and New

Eyeing HFT monitoring, big data initiatives.

Transaction-Cost Analysis' Fixed-Income Evolution

TCA is moving from equities into fixed-income towards becoming a real-time analysis tool.

Franklin Templeton Taps Silverfinch Ahead of Solvency II

Asset manager builds secure channel for insurer clients' asset reporting.