Microsoft

Waters Wrap: Snowflake Makes its Move (And Ref Data Headaches & Data-Sourcing-as-a-Service)

Anthony explores how Snowflake is trying to win over business in the cap markets, talks about the reference data space, and examines a new breed of data vendors.

Snowflake Looks to Tackle Data Problems of Asset Managers, Exchanges

Snowflake is already working with the New York Stock Exchange on how to make its data easier to access for the pair’s overlapping clients.

Waters Wrap: Exchanges Look to the Cloud (And More on ESG, M&A, and Vaccine Tracking Data)

As exchanges partner with cloud providers to move more functions to the cloud, Anthony wonders if these partnerships could become competitive in the future.

Multicast: The ‘Holy Grail’ for Getting Exchanges to the Cloud

Cloud providers are hunting for a way to bring multicasting to the cloud for low-latency market data distribution, unlocking the gateway for traditional exchanges to shift core infrastructure to the cloud without negatively impacting high-speed trading.

Waters Wrap: The Race to the Cloud (And More on Name Changes, Reg Reporting, & Covid Data)

Anthony Malakian examines how firms are racing to the cloud to roll out new market data services. He also looks at ChartIQ's name change, the regulatory reporting space, and Lazard's Covid-19 data rollout.

This Week: BNY Mellon, ASX, DTCC, SteelEye/UnaVista & More

A summary of some of the past week’s financial technology news.

Esma Guidelines Call for Full Audits of Cloud Providers

The regulator is consulting on outsourcing contract guidance that would give firms and supervisors access to the books and premises of providers.

Two Former Fidessa Employees Make Push into OMS Interop Space

Two former Fidessa employees are working with Glue42, which in turn is working with Fidessa and Ion, on bringing interoperability to the OMS space.

Covid Provides RPA a Chance to Shine, but Skeptics Remain

The pandemic has highlighted the need for greater automation, leaving some retail banks to embrace RPA, which could seep into the wholesale capital markets.

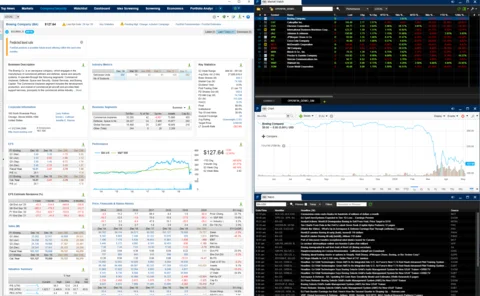

FactSet Embraces Web Technologies for Workstation

The research and data giant is using OpenFin to build out web capabilities for its Workstation platform.

BlackRock Onboards 8 Aladdin Clients Remotely

The asset management giant has turned to collaboration tools to help with client implementations during the pandemic lockdown.

Goldman Sachs Revamps Virtualization Infrastructure

The investment bank is leveraging Red Hat's OpenShift technology to better manage its global footprint of virtual machines.

Charles River Pushes Ahead with Azure Cloud Migration

The vendor has, however, seen some clients pause their migration plans due to the Covid-19 outbreak.

This Week: State Street/Microsoft; Refinitiv/Global Relay; SimCorp/Anima; TSE & More

A summary of some of the past week's financial technology news.

Citco Migrates Accounting Platform Clients to AWS

The firm plans to complete the migration by the end of summer, as it learns from prior rebuilds.

In Expansion Beyond HFT, FPGAs Eye AI

After a decade of supercharging low-latency applications, Wei-Shen Wong explores how FPGAs are pushing into new areas of the capital markets, driven by interest in AI & ML.

Linedata Looks to Expand Public Cloud Strategy

Linedata has moved its applications to AWS and aims to have support for Microsoft Azure by the third quarter.

Finastra Looking to Partner with Fintechs for Marketplace Platform

The financial technology giant is looking for partners who work in regtech, risk or predictive analytics.

Game On: Can the Video Game Industry Teach Banks Something About Visualization?

Capital markets firms are continually looking for new ways to package and visualize a rising tide of information. It turns out there’s another industry looking to handle the same challenge—the video game industry.

Vendors Feel Heat as Regulators Pile Pressure on Third-Party Resiliency

UK regulators have proposed new laws to clamp down on operational resilience and third-party risk, pushing fintechs to put some skin in the game.

Google Exec: Regulators Insisting on Multi-Cloud for Financial Firms

As regulators fear vendor lock-in and concentration among cloud providers, Google Cloud pushes its Anthos platform.

Proliferation of Fake Information: Deepfakes & the Capital Markets

As the spread of false information online threatens our view of the world, Josephine Gallagher examines how this phenomenon has evolved with technology.

For the App Interoperability Movement, 2020 will be a Big Year

While progress was made in the desktop application interoperability space in the last year, Anthony Malakian says 2020 is likely to see some major developments that will help to push this movement forward.

Blockchain in the Capital Markets: Slow Progress in 2019

While real blockchain rollouts are still few and far between, some firms made progress in 2019. Here are 18 projects in some stage of development.