Intercontinental Exchange

ICE, DTCC Announce Closure of NYPC

The IntercontinentalExchange (ICE) and the Depository Trust and Clearing Corporation (DTCC) have announced that New York Portfolio Clearing (NYPC) will be wound down, with interest-rate futures listed on NYSE Liffe US moving to ICE Clear Europe.

ICE and CME Receive Trade Repository Approvals

Intercontinental Exchange Group and the CME Group have both received regulatory approval to operate a Trade Repository (TR) for the reporting of swaps and futures trade data under the European Market Infrastructure Regulation (EMIR).

Quincy Microwaves ICE, Eyes Lower Latency

Oakland, Calif.-based low-latency connectivity and market data provider Quincy Data will next year begin distributing US and European futures data from IntercontinentalExchange via its Quincy Extreme Data service, to support the low-latency arbitrage…

Opening Cross: Big Data, Small Print

The London Stock Exchange's consolidated data policy could bring benefits to end-users, though in most cases, more data and delivery mechanisms still means more fees.

ICE Moves Hutcheson from Liffe to LIBOR

IntercontinentalExchange, the new owner of NYSE Euronext and its NYSE Liffe derivatives market, has appointed Liffe chief executive Finbarr Hutcheson president of ICE Benchmark Administration, the renamed NYSE Euronext Rate Administration business, which…

ICE Plans to Divest NYSE Technologies; Will Keep Data Centers

IntercontinentalExchange (ICE) plans to sell much of the NYSE Euronext's NYSE Technologies data and technology business, following its acquisition of the New York-based exchange group, said ICE chairman and chief executive Jeffrey Sprecher on a…

Sprecher: ICE to Keep Datacenters, SFTI; Will Sell NYSE Technologies Assets

IntercontinentalExchange plans to divest much of the NYSE Euronext's NYSE Technologies data and technology business, following its acquisition of the New York-based exchange group, said ICE chairman and chief executive Jeffrey Sprecher on a conference…

Merger MegaDeals Lead Exchanges to Mull Tech/Data Integrations

The IntercontinentalExchange (ICE) this week announced the successful completion of its $11 billion stock and cash acquisition of NYSE Euronext. But challenges still lie ahead for the two exchanges, which now face the prospect of a much greater…

Nations and Exchanges

I'm in New York this week, and I can honestly say that I haven't been anywhere that's more beautiful in the autumn. Granted, Long Island and beautiful aren't two words that necessarily go hand in hand for most people, but the colors on display really are…

Will Consolidation or Fragmentation Follow NYSE–ICE, Bats–Direct Edge?

NYSE Euronext–IntercontinentalExchange (ICE) and Bats–Direct Edge have cleared most regulatory hurdles—NYSE–ICE is days away from being cemented, according to reports, and Bats–Direct Edge just received approval from the US Justice Department. So the…

NYSE Euronext and ICE Postpone Merger Closing Date

NYSE Euronext and IntercontinentalExchange (ICE) have delayed the closing date of the $8.2 billion merger transaction, as the deal is still pending European regulatory approvals.

ICE to Close NYSE Acquisition on Nov. 4

NYSE Euronext announced today that its acquisition by IntercontinentalExchange (ICE) will close on Nov. 4.

Edwin Marcial: No More Mr. ICE Guy

Edwin Marcial has been in the technology driver’s seat since before ICE’s meteoric rise. In the early 2000s, he wore the ‘upstart’ label like a badge of honor. But with the purchase of the NYSE, he doesn’t seem so comfortable with it anymore. By Jake…

Tech Questions Loom After Major Exchanges Tie the Knot

A period where no meaningful exchange M&A made it to the finish line has been followed by two announced megadeals that appear likely to be approved. Jake Thomases looks at what IT advantage is gained by such massive mergers, and whether these latest…

Direct Edge's William O'Brien on the Bats Merger

After much speculation on Friday last week, news broke today that Direct Edge would merge with Bats. Direct Edge's CEO William O'Brien hopes that this will help the newly combined entity, which will go forward under the Bats name, to break into the…

Cetip Offers ICE Link for Brazilian Trading

Intercontinental Exchange (ICE) has announced that its ICE Link tool for post-trade processes in credit-default swap trading has been made available on Cetip|Trader, the service provider's platform for Brazilian fixed income.

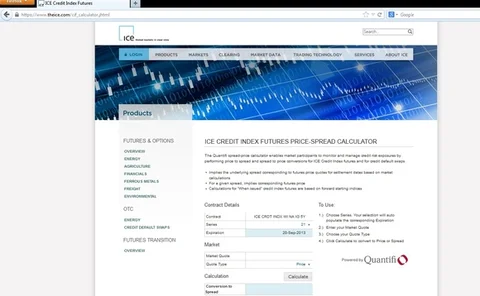

Quantifi Tapped for ICE Futures Price-Spread Calculator

The analytics provider has released a new tool for pricing credit index futures listed by IntercontinentalExchange (ICE) Futures U.S., backing increased demand for exchange-traded futures, which trade more cheaply than OTC derivatives under new global…

NYSE-ICE Deal Approved by SEC

The US Securities and Exchange Commission (SEC) has given its blessing to the proposed acquisition of NYSE Euronext by the IntercontinentalExchange group.

NYSE-ICE Acquisition Proposal Gains Shareholder Approval

Shareholders in NYSE Euronext have approved the acquisition of the stock exchange giant by IntercontinentalExchange (ICE), one of the first steps in the formalization of an entity that spans equities, commodities and derivatives trading.

Back Office Vendors Talk About What's on Tap

A group of back office vendors at the Futures Industry Association (FIA) New York Expo had a chance to brag about the most exciting product they have on offer, or in the works. This is what they offered up.

DTCC Files Legal Challenge to CFTC's Swap Reporting Rules

The New York-headquartered company says the regulator has introduced anti-competitive rules that will increase costs for market participants by allowing clearing houses to control which swap data repositories they report to