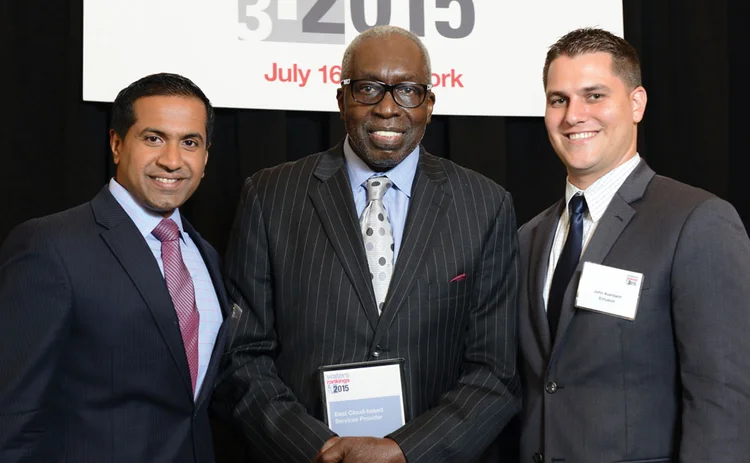

Waters Rankings 2015: Best Cloud-Based Services Provider ─ Enfusion

Enfusion operates out of three offices globally in New York, Chicago and London.

The beauty of cloud-based solutions is that they can be delivered remotely to any location in the world, and with three offices-Chicago, New York and London-Enfusion has clearly embraced this concept wholeheartedly. Primarily targeted at hedge funds and alternative investment managers, the Integráta platform is a portfolio and order management system delivered as a fully hosted solution, covering the entire operational life cycle of investment management and trading activities. According to the firm, its global client base holds more than $90 billion of assets under management-not huge by any measure, but a remarkable increase from a figure that stood at around $13 billion just two years ago.

The platform's portfolio management function supports cross-asset trading, while its order management system enables trading with over 100 executing brokers via direct FIX connections to high-touch, direct market access, and full algo suite destinations.

Trading valuation and risk exposure calculations are managed through a dedicated module that provides a range of tools for risk exposure calculation, portfolio stress-testing, price sourcing, and market data. The platform boasts connectivity tools covering trade affirmation, end-of-day trade delivery, portfolio exports and electronic trade capturing. Integráta also offers its users an end-to-end portfolio management solution, delivered, according to Enfusion, in a manner that does not burden the infrastructure further, a key differentiator when the need for agility and transparency within the capital markets is greater than ever.

Through partnerships with other market players including Omgeo, which has now fully completed its DTCC transition, and London-based data giant, Markit, Enfusion also helps capital market participants comply with regulatory requirements such as mandatory clearing requirements for OTC derivatives as dictated by the Dodd-Frank Act.

For smaller firms to compete in an arena dominated by industry giants, it must be well positioned to provide the right service in the right channels. Enfusion's triumph illustrates that the firm knows what the market wants and has found the winning formula for delivering it.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Awards & Rankings

Witad Awards 2025 winner’s interview: Maureen Downs (Connamara Technologies)

Video interview with Connamara Technologies co-founder, and winner of the trailblazer vendor category in the 2025 Witad Awards, Maureen Downs

Buy-Side Technology Awards 2024 winner’s interview: FactSet

Video discussion on FactSet’s trio of wins in the 2024 BST Awards

Witad Awards 2025: Vendor professional of the year (business development)—Ripple Bhullar, Kyndryl

Ripple Bhullar, vice president, head of US capital markets and diversified, at Kyndryl, wins vendor professional of the year (business development) in the 2025 Women in Technology and Data Awards.

Witad Awards 2025: Technology leader of the year (vendor)—Mary Cecola, Broadridge Financial Solutions

Mary Cecola, CTO for asset management at Broadridge Financial Solutions, wins technology leader of the year (vendor) in the 2025 Women in Technology and Data Awards.

Witad Awards 2025: Trailblazer (Lifetime achievement) award (vendor)—Maureen Downs, Connamara Technologies

Maureen Downs, co-founder and chair of Connamara Technologies, wins the Trailblazer (Lifetime achievement) award (vendor) in the 2025 Women in Technology and Data Awards.

Witad Awards 2025: Legal/compliance professional of the year—Devi Shanmugham, Tradeweb

Devi Shanmugham, global head of compliance at Tradeweb, wins legal/compliance professional of the year in the 2025 Women in Technology and Data Awards.

Witad Awards 2025: Technology innovator of the year (end-user)—Ruchi Acharya Saraswat, RBC Capital Markets

Ruchi Acharya Saraswat, managing director, head of strategy and transformation, business and client services technology at RBC Capital Markets, wins technology innovator of the year (end-user) in the 2025 Women in Technology and Data Awards.

Witad Awards 2025: Best company for diversity and inclusion (end-user)—BNP Paribas Portugal

BNP Paribas Portugal wins best company for diversity and inclusion (end-user) in the 2025 Women in Technology and Data Awards.