Emerging Technologies

Google gifts Linux, capital raised for Canton, one less CTP bid, and more

The Waters Cooler: Banks team up for open-source AI controls, S&P injects GenAI into Capital IQ, and Goldman Sachs employees get their own AI assistant in this week’s news roundup.

Numerix strikes Hundsun deal as China pushes domestic tech

The homegrown tech initiative—‘Xinchuang’—is a new challenge for foreign vendors.

RBC’s partnership with GenAI vendor Cohere begins to bear fruit

The platform aims to help the Canadian bank achieve its lofty AI goals.

Deutsche Bank casts a cautious eye towards agentic AI

“An AI worker is something that is really buildable,” says innovation and AI head

TMX buys ETF biz, Iress reinvests in trading tools, UBS data exposed, and more

The Waters Cooler: Euroclear’s next-gen service, MarketAxess launches e-trading for IGBs, and new FX services are in this week’s news round-up.

SEC pulls rulemaking proposals in bid for course correction

The regulator withdrew 14 Gensler-era proposals, including the controversial predictive data analytics proposal.

Waters Wavelength Ep. 322: Navigating air travel and cybersecurity

This week, Reb, Nyela, and Shen discuss concerns around air travel and notable cybersecurity incidents.

Cloud offers promise for execs struggling with legacy tech

Tech execs from the buy side and vendor world are still grappling with how to handle legacy technology and where the cloud should step in.

Deutsche Bank to debut tokenization platform in November

Dama 2 minimizes up-front hardware and infrastructure costs for firms exploring tokenization.

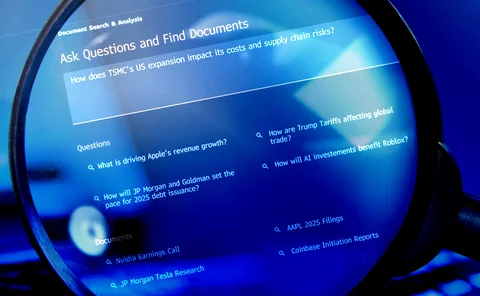

Bloomberg expands user access to new AI document search tool

An evolution of previous AI-enabled features, the new capability allows users to search terminal content as well as their firm’s proprietary content by asking natural language questions.

Agentic AI takes center stage, bank tech projects, new funding rounds and more

The Waters Cooler: SEC hack investigation, FCA–Nvidia partnership, LTX BondGPT upgrade, and CDO problems are also in this week’s news round-up.

Waters Wavelength Ep. 321: AccessFintech’s Par Cassells

This week, Par Cassells joins Nyela to discuss shorter settlement cycles and the role of vendors in the transition.

Perceive, reason, act: Agentic AI, graph tech used to assess risk

Industry executive Jay Krish is experimenting with large language models to help PMs monitor for risk.

BNY standardizes internal controls around data, AI

The bank has rolled out an internal enterprise AI platform, invested in specialized infrastructure, and strengthened data quality over the last year.

NY Fed Home Loans Bank spurns multi-cloud model

The cost and complexity of diversifying away from the big three providers outweighs concentration risks.

Citi close to launching GenAI investment tools

The new tech will be used to improve investment recommendations and increase cross-selling opportunities.

Overnight trading, a new dealer-to-client credit biz, so much AI, and more

The Waters Cooler: TP Icap acquires Neptune, Sterling launches overnight trading, and Thoma Bravo gets billions from investors in this week’s news round-up.

First Citizens used AI to retain SVB customers

The firm’s retention efforts involved using AI to monitor customer behavior and sentiment—including profanities.

Waters Wavelength Ep. 320: Tradeweb’s Chris Bruner

This week, Tradeweb’s Chris Bruner joins the podcast to discuss digital assets and fixed income.

Tech vendors, exchanges see gains from GenAI code assistants

CME Group and others report their experiences using code assist tools to generate code, support tech migrations, and speed up testing, and support functions.

Talos’s new crypto risk assets drive portfolio management system upgrade

One year after Talos Trading acquired Cloudwall, the vendor has added new capabilities to its portfolio management system.

Deutsche Bank toys with tokenizing, MayStreet sues LSEG, S&P Global adds data to Databricks, and more

The Waters Cooler: A German consortium looks to enter a deal with the EU on AI datacenters; MayStreet’s founder sues LSEG; and buzz about product expansions in this week’s news roundup.

Everything’s a chatbot. Soon, your sales trader might be, too

Morgan Stanley, Citi, and Kepler Cheuvreux are among firms considering making their internal AI assistants available to clients.

Waters Wavelength Ep. 319: Bloomberg IB chat and operational resiliency

Tony and Shen discuss Bloomberg’s addition to IB chat, common threads in our Voice of the CTO series, and op resiliency.