Max Bowie

Max is editor-at-large at WatersTechnology, based in Infopro Digital's New York office.

Max joined then-Risk Waters Group (prior to its acquisition by Incisive Media) in 2000, and has worked as a reporter on Risk Magazine, FX Week, Trading Technology Week (now Sell-Side Technology) and Buy-Side IT (now Buy-Side Technology), before joining Inside Market Data as European reporter in 2003. He moved to New York as US reporter in 2005, and became editor in 2006. He was a contributor to sibling Inside Reference Data, and was founding editor of Inside Data Management, which merged the IMD and IRD newsletters into a monthly glossy magazine.

Follow Max

Articles by Max Bowie

TRG Screen Melds FITS, InfoMatch for Next-Gen Data Cost Management Platform

The first iterations of the new Optimize platform will be available early next year.

Financial Sector Should Commercialize Data Management Knowledge to Advance Other Industries

Just as there’s always money to be made from doing dirty jobs, there are opportunities around dirty data—especially in industries that are only now beginning to appreciate the value of being data-driven.

Mike Meriton: The Man Who Wrote the ABCs of EDM

This year's inductee to the Inside Market Data Hall of Fame is Mike Meriton, co-founder and COO of the EDM Council.

Refinitiv Begins Move Away from Eikon, Thomson One with Debut of 'Workspace'

The new platform is first being targeted at advisors and wealth managers, and will eventually be available for traders, analysts, portfolio managers, quants, and developers.

BNY Mellon Preps Fintech Accelerator Program to ID Key Tech Solutions

The Connect20 hackathon and the Accelerator Program are designed to "industrialize" BNY Mellon's ability to identify early stage companies providing solutions to key technology and business challenges facing the firm.

Data Issues Still Hamper AI—But AI Can Fix Them

Instead of waiting for data quality to be sufficient to power AI models, those at the cutting edge are building models to bridge the gaps in the data, and apply it to more sophisticated use cases.

OTC Markets Unveils ‘Blue Sky’ Compliance Dataset for OTC Securities

The dataset is part of an ongoing initiative by the OTC marketplace to gain state-by-state exemptions to allow brokers and issuers to conduct business in OTC securities.

This Week: CME, Katana/IHS Markit, S&P, SmartStream, Causality Link & More

A summary of some of the past week’s technology news

Bank Execs: Covid’s Tech Challenges Handed ‘Big Wins’ to Automation, AI

Emerging tech is proving its worth since the Covid-19 outbreak, and are swaying skeptics towards even greater adoption, panelists said.

FactSet Close to Debuting Cloud Ticker Plant

The vendor says it will be the first major data provider to deliver a ticker plant running completely in the cloud.

Trust Issues: As Zero-Trust Architectures Mature, Bank Infrastructures Face 'Growing Pains'

Coronavirus has heightened the need for IT and data security, exposing areas for potential improvement. One option is to lock down sensitive areas using a practice called Zero-Trust Architecture, which offers a host of benefits, but brings with it some…

Does Your Board Have Zero Trust?

Financial firms’ boards are increasingly taking a more hands-on role towards IT security—thus driving adoption of important new security measures for their firms and the industry as a whole.

EKG Foundation Preps Industry Consultation, Touts Benefits of Knowledge Graphs for Capital Markets

EKGs will allow financial firms to take advantage of new and existing datasets to serve purposes from upselling, AML and KYC, and regulatory reporting.

EOSE Preps Bespoke Data Sourcing Service for Financial Firms

The move is in response to inbound demand from firms seeking hard-to-find datasets.

Wavelength Podcast Ep. 209: Previewing the Innovation Exchange

Wei-Shen and Tony are joined by Jo Wright and Max Bowie to discuss office-space issues, ESG's development, and innovation in Asia.

Industry Vet’s Startup Consultancy Targets Brokers’ Data Sales, Licensing Needs

Mike Kirby will use his experience to help brokerages put licensing structures around their data to generate revenues and reduce risks.

Location, Location, Relocation: Covid Prompts Firms to Re-Tool vs Reopen

It’s technology that has helped firms continue working seamlessly through the outbreak, and Max says this same technology will keep the markets running smoothly—and remotely—in the future.

SteelEye Unveils Tool to Slash Trade Reconstruction Timeframes

Officials say the new product will enable firms to aggregate and correlate the data required to fulfill trade reconstruction obligations within seconds.

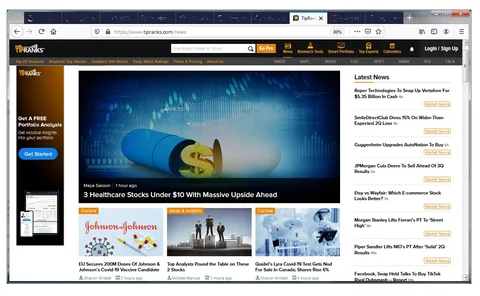

TipRanks Builds Financial News Service to Highlight Analyst Ratings Data

The vendor provides ratings of research analysts, bloggers, and other stock tipsters.

CanDeal Leverages Canadian Data Pooling Model to Build Data & Analytics Business

DNA will use CanDeal's unique position-capturing data from the country's top broker-dealers to create new data services.

NERD Alert: S&P Taps Kensho to Add IDs, Data Links to Mentions in Historical Transcripts

The move marks the start of plans to expand the distribution of Kensho's entity and individual recognition and tagging system.