John Brazier

John Brazier is the deputy editor for Sell-Side Technology, having joined Waters in January 2015 as a European staff writer and previously served as Buy-Side Technology deputy editor. Prior to Waters, John covered the UK consumer credit and insolvency sectors. Based in London, John covers industry issues, trends and developments for buy-side technologies.

Follow John

Articles by John Brazier

Sell-Side Technology Awards 2015: Best Cloud Provider to the Sell Side — BT

BT also won in the best sell-side trading network category.

Sell-Side Technology Awards 2015: Best Infrastructure Provider to the Sell Side — Perseus

This is Perseus' first win at the Sell-Side Awards.

First Bitcoin-Based Security Authorized on Nasdaq Stockholm

XBT Provider to launch first virtual currency instrument on regulated exchange.

Bloomberg Adds Exane BNP Paribas for Real-Time Algorithm Monitoring

Algorithm tool provides European equities traders with real-time feedback.

EquiLend Securities Finance Trading Platform NGT Goes Live

Platform looks to capitalize on demand for efficiencies in securities finance trading activities.

BoA Merrill Lynch Handed £13.2 Million Transaction Reporting Fine

Record fine handed down by UK regulator FCA for incorrect reporting of 35 million trades.

SocGen Launches Collateral Management Outsourcing Solution, Tempo

Multi-asset offering for buy and sell sides to alleviate collateral management complexity.

SIX Swiss Exchange CEO Christian Katz to Depart

Katz to leave Swiss Exchange due to “diverging views” on strategy and future of the exchange.

Plato Partnership Trading Platform Aims to Change the Market Model

Collaboration of buy and sell side to fund market optimization research through new utility.

Plato Partnership Trading Platform Aims to Change the Market Model

Collaboration of buy and sell side to fund market optimization research through new utility.

Teknometry Rolls Out GIPS Compliance Tool, TekGAM

Standalone solution launched for simplification of Global Investment Performance Standards.

Aquis Exchange to Debut 'Market at Close' Order Type

MaC order type to offer alternative to end-of-day auctions.

Saxo Bank Extends White-Label Offering with Stock Options Trading

Stock options trading was previously only available to private & institutional investors.

Torstone Expands Inferno Platform with US Module

Module designed to meet demand for offshore products among US domestic clients seeking diversification.

Steve Briscoe to Head up LCH.Clearnet’s Technology and Operations

New hire to oversee technological and operational processes across group’s legal entities.

Daewoo Securities Taps Ullink for High Frequency Trading Platform

Ullink trading platform to provide low latency solution for HFT clients.

ISDA Calls for Derivatives Standardization Through SEF Flexibility

Report aims to harmonize regulatory efforts at derivative market standardization.

On Everyone’s Radar: The Short History of Cyber Crime

Cyber crime is not a new trend and as the volume of attacks increase lessons can be learned from historic cases.

Confusion Still Hinders European Derivatives Reporting Transparency

One year after the start of OTC derivatives trade reporting, there are still underlying issues dogging the project.

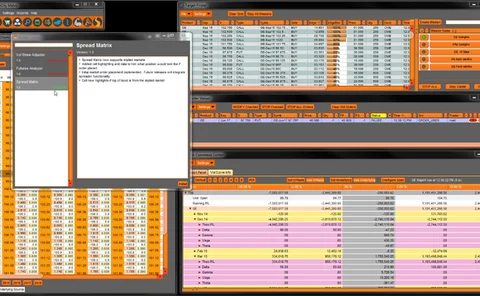

OptionsCity Launches Rebranded, Web-Based Metro NOW

Metro NOW offers traders a customizable options and futures trading platform.

BATS’ Hotspot Launches London-Based Matching Engine

Hotspot's average daily volume Q4 2014 was $31.7 billion.

Four Additional AMs Join Plato Partnership

AXA Investment Managers, Union Investment, JPMorgan Asset Management and Fidelity Worldwide Investment Sign Up.

Four More Asset Managers Join Plato Partnership

AXA Investment Managers, Union Investment, JPMorgan Asset Management and Fidelity Worldwide Investment Sign Up.

China Construction Bank Extends TRACE Use for FX Derivatives Reporting

CCB will also adopt hosted solution for TRACE platform for FX derivatives reporting.