Dan DeFrancesco

Dan DeFrancesco is the deputy editor for Sell-Side Technology and has been a member of the Waters' team since August 2014. A native of upstate New York, Dan got his start in journalism as a sports reporter at The Journal News, a daily newspaper that covers the Hudson Valley, after spending a year coaching lacrosse in Manchester, England. Dan is also in charge of Waters' social media accounts. You can follow him on Twitter @dandefrancesco.

Follow Dan

Articles by Dan DeFrancesco

BST North America Panel: Will Cloud Kill the IT Department?

As more firms outsource technology solutions via the cloud, one asset manager questions the need for an internal technology department at all.

BST North America Panel: Different Approaches to Improving Data Management

At the Buy-Side North American Summit, held this week in New York, end-users and vendors on the buy side discussed improvements firms can make to their data management.

SimCorp Poll: Only 23 Percent on Buy Side Can Perform Intraday Calculations

Investment management solutions provider SimCorp has released a poll that surveyed 60 executives from North American-based capital market firms about performing intraday calculations on the impact of position-driving events.

Portware to Offer S3's Counterparty Intel Analytics Platform to Clients

S3 announced its Basel III analytics solution, Blacklight, will be available for all Portware clients.

BST North America Panel: Derivatives Regulation Creates Tech Limbo, Opportunities

A panel of industry experts discussed the impact regulation of OTC derivative trading will have and what the future holds for the market at 2014's Buy-Side Technology North American Summit.

C-level Panel Talks Information Security at BST North American Summit

The evolution of information security was discussed at a C-level roundtable at this year's Buy-Side Technology North American Summit in New York.

BGC Partners Taps Hirschhorn as CIO

Brokerage BGC Partners announced Eric Hirschhorn will take over as the firm's chief information officer immediately.

Ovum Reports on Mobile Call Recording in Capital Markets

With regulations on both sides of the Atlantic requiring firms to record and archive mobile phone conversations of traders, companies have to decide how to remain compliant as regulators look to make the increase communications transparency in the market.

SROs Submit Plan for Audit Trail, Initial Costs Estimates Average $53 Million

A group of self-regulatory organizations (SROs) selected by the Securities and Exchange Commission (SEC) submitted its plan to build, implement and maintain the Consolidated Audit Trail (CAT) that will track activity in every National Market System (NMS)…

Stock Order Worth $617 Billion Cancelled in Japan's OTC Market

Shares in 42 companies adding up to $617 billion were canceled in Japan's over-the-counter market thanks to a trading error, according to a report from Bloomberg.

Finra Proposes Rule to Protect Investors, Analyze Brokerages

The Financial Industry Regulatory Authority (Finra) has begun soliciting comments for a proposed rule that would require brokerages to periodically report information on their securities accounts and the securities accounts for which they clear.

Rimes to Include Thomson Reuters' Indices in Rimes BDS

Rimes will add several equity and fixed income indices from Thomson Reuters on its Rimes Benchmark Data Service (Rimes BDS) in order to expand its database and meet the growing demands from the buy side for more data.

Bent Takes Over SS&C GlobeOp's Fund Administration Operations in Asia

SS&C Technologies Holdings announced Stewart Bent will lead SS&C GlobeOp's fund administration business in Asia as its managing director in the region.

Xignite Debuts New Software Development Kits

Market data provider Xignite is rolling out new Software Development Kits (SDKs), which will debut at the FinDEVr conference in San Francisco over the next two days and be available for Java and .NET on GitHub.

Vista Equity Partners acquires Tibco for $24 per share

Tibco Software, an infrastructure and business intelligence software company, announced its board of directors has agreed to be acquired by Vista Equity Partners, a private equity firm, for $4.3 billion.

SunGard Unveils Solutions to Manage Corporate Actions Risk

SunGard announced the launch of XSPosure, a cloud-based risk dashboard designed to reduce corporate actions risk exposure.

Investor, Regulatory Demands Drive Latest Linedata Rollout

Yesterday, it was announced that Linedata had enhanced Linedata Global Hedge, its overarching platform for hedge fund managers.

Updated Version of Linedata Global Hedge Released

Linedata announced an upgrade to its technology platform for hedge fund managers, Linedata Global Hedge.

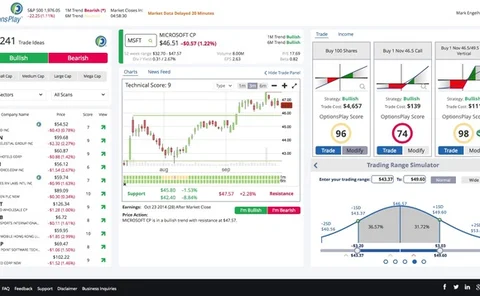

OptionsPlay Ideas Available on Scivantage Investment Platforms

Scivantage will offer OptionsPlay Ideas, an equities and options investing tool, through its Scivantage Investor and Scivantage Professional platforms.

BVL Extends Relationship with CameronTec

The Peruvian Exchange, Bolsa de Valores de Lime (BVL), will further expand its relationship with CameronTec by using its VeriFIX automated testing tools on its new Millennium trading platform.

Sparinvest picks SunGard

Denmark-based asset manager Sparinvest will use SunGard’s XSPrisa to automate its global corporate actions processing.

IT Spend Trends Toward Public Cloud

Even with limited budgets, firms are increasingly willing to invest in the public cloud.

Taylor to Lead CME Group's Technology and Platform Development

As part of a new leadership structure, CME Group announced Kim Taylor will now serve on its executive team as the president of global operations, technology and risk.

Slow Budget Growth Prompts New Spending Strategies

Anemic technology budget growth—a large portion of which is tied up in compliance—means firms are looking to make the most of the money they do have to spend on IT. Strategies for stretching the available dollars include restructuring budgets and…