MarketAxess’s Solenn Maton and Julien Alexandre discuss how CP+ powers transaction cost analysis (TCA) to deliver real-time insights and improve trade performance in complex markets.

Need to know

- Good data can support the entire trading life cycle

- The choice of the benchmark is key

- TCA is more than a post-trade exercise for best execution requirements—it is also a pre-trade tool to inform on how to trade and optimize execution outcomes.

Amid increasing trading complexity, TCA is emerging as a key tool for optimizing trade performance. Julien Alexandre, global head of quant research, and Solenn Maton, senior manager, quant research at MarketAxess, discuss how CP+, the MarketAxess pricing engine, serves as a critical driver for TCA with unbiased, real-time insights that enhance decision-making across the trading life cycle.

Choice of unbiased benchmark

Access to raw data is proliferating. However, if this data isn’t cleaned or actionable, its value is limited. CP+, the MarketAxess artificial intelligence (AI)-powered algorithmic bond pricing engine, consumes millions of data points across various sources, from indicative streams to market trades, and extracts insights and patterns from them. It is consistent and unbiased; by using the same methodology across very different market environments, and within the same market conditions, it provides consistent results across a broad range of market subsets (more/less liquid, long/short maturity, and so on). CP+ also indicates where the trades are printing now. This makes it the benchmark of choice to accurately reflect the cost of trading.

Why TCA matters

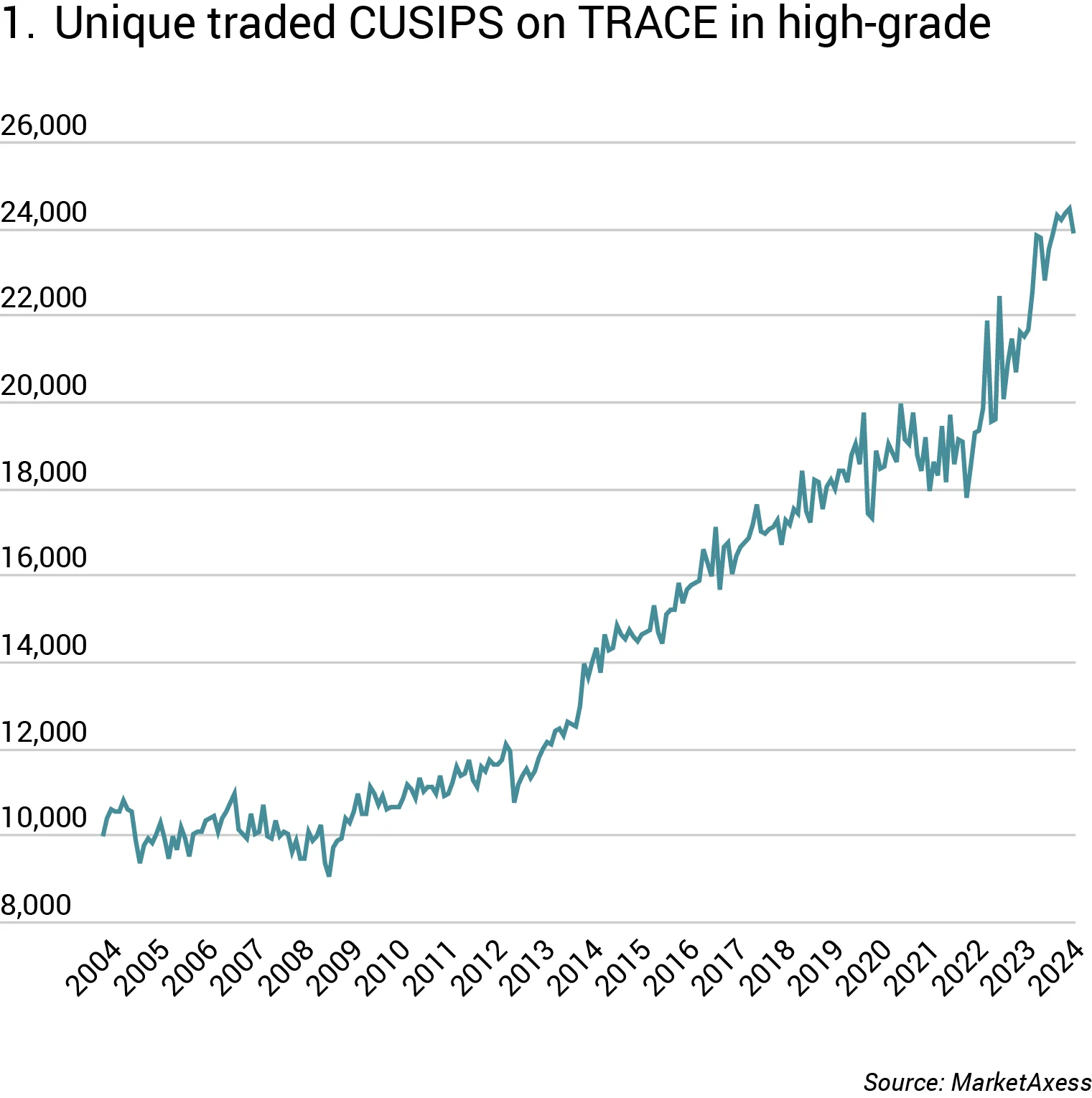

With a sharp increase in the number of securities in recent years, navigating ‘what to trade’ is becoming more difficult. We have seen the number of unique securities traded in high-grade through to trace more than double in the past 10 years.

We are also seeing the rise of new protocols—including portfolio trading and automation—increasing the complexity of ‘how to trade’. The importance of data and actionable insights is thus rising. Understanding TCA outcomes enables optimization of protocol selection, helping to define how to trade. TCA can be performed at an aggregated level to identify patterns of under/overperformance, which can be used to improve real-time decisions. TCA is used as a signal to calibrate the next trading decisions by assisting traders with the key questions of what and how to trade.

Pre-trade TCA

CP+ allows traders to evaluate the pre-trade cost of trading by using the CP+ bid/ask spread, which provides the expected round-trip cost. It is also used as a key component in portfolio construction.

Expansions of CP+ are also available to account for how the order is executed. We have developed these to assist traders regardless of their protocol of choice. For liquidity takers, CP+ Inquiry helps to assess cost of trading depending on the size of inquiries. CP+ Responder, on the other hand, provides guidance for liquidity providers to help them achieve win-rate targets.

Trading workflow

CP+ and its expansions are here to help traders throughout their execution. It can even take a more central position and drive execution directly by being embedded as an input into automation strategies. We’re seeing an increased share of volume that is executed through our Auto-X protocol, where CP+ can be used as an execution parameter.

Post-trade TCA

We can use CP+ to inspect trading execution from two angles: the bond dimension and the order-specific features.

- One can focus on the bond attributes using the delta between trade level and CP+ Mid. This delta shows the round-trip cost of trading. The two main drivers of transaction costs are liquidity and maturity (proxy for risk). This delta versus mid is thus a key element when looking at what to trade.

- One can also focus on the specific order features and remove the bond dimension by using the delta between the trade level and CP+ side. In this case, we analyze the impact of size, timing and protocol. The delta allows the trader to make informed decisions on when and how to trade. It can be leveraged to uncover patterns of execution. Post-trade analysis is used as a signal to inform the next pre-trade decision on how to trade and which protocols are the best fit based on the order.

TCA optimization: what’s next?

Analysis of TCA is a key element in optimizing trading outcomes. Understanding one’s TCA can be used to refine what to trade, as well as how and when. We also want to assist our clients and go one step further by building tools that will identify ‘who to trade with’. Counterparty selection is a central theme, particularly important in high-touch trading where reducing information leakage is paramount.

CP+TM: MarketAxess’s proprietary AI-powered pricing engine for corporate bonds. It produces an unbiased, two-sided market for more than 33,000 instruments worldwide. Updated every 15–60 seconds, the engine generates nearly 30 million levels daily, covering 90–95% of trading activity in its markets.

Relative liquidity score: provides a defined measurement of the current liquidity for individual bonds and highlights the potential ease with which a trader can expect to transact in that instrument. It covers nearly 36,000 bonds daily, with scores ranging from 10—the highest level of liquidity—down to 1.

Transaction cost analysis: is defined relative to CP+ and computed as the difference between the trade price and the CP+ price on the corresponding side at inquiry time. A positive value means the trade occurred inside (more competitive than) the CP+ bid or offer, while a negative value means the trade occurred outside (less competitive than) the CP+ bid or offer.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com