Dash Releases New Dashboard for Order-Routing Visualization, Execution

Dash360 is geared toward bringing transparency to the US options market.

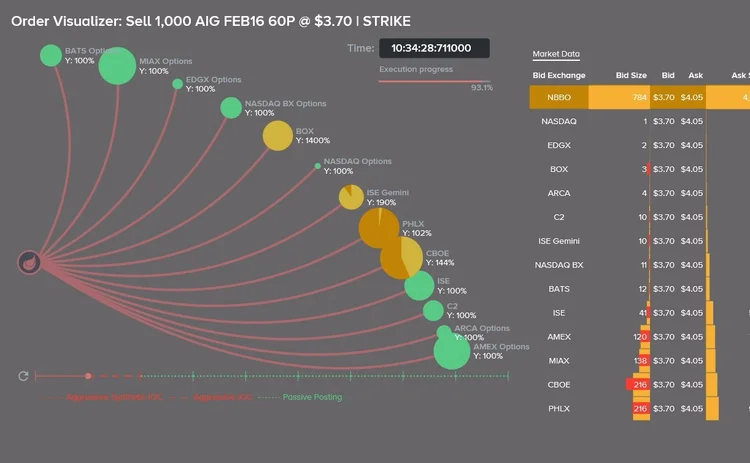

The web-delivered HTML5 dashboard includes an order visualizer that incorporates animation to visualize order-routing decisions and the resulting best execution performance.

Dash360 shows all aspects of the order lifecycle in visualized and non-visualized data formats, including routing information, execution detail, order-book detail, venue analysis and exchange reconciliation. The platform also features a widget that provides users with a suite of summary analytics and graphics in real-time to their desktop/laptop, tablet or smartphone.

“Having the ability to visualize every aspect of the router’s behavior allows a trader to immediately get feedback on the specific nuances that affect their own performance and make better decisions surrounding router configuration or algorithm selection in different circumstances,” says David Karat, chief marketing officer and co-founder of Dash Financial. “The ability to customize every aspect through the Algo Wizard in real time without lengthy code-change cycles creates a customized solution that augments the data to provide tailored electronic execution for any strategy or preference.”

Historically, many traders have been in the dark as to the total cost of an execution once the various complicated fee structures are added to their order, Karat says.

The new dashboard gives immediate feedback on each and every cost associated with their order, as well as how the product fared in the pursuit of the liquidity available. All of this data gives management and stakeholders complete transparency into best execution, he says.

The new dashboard’s visual capabilities were also created with increasing regulatory demands in mind. “We founded Dash to exceed best execution requirements from the buy-side’s perspective and transparency was clearly an area of the industry that we felt needed significant improvement. Mifid II and other market structure and regulatory trends are pushing the transparency theme further,” says Karat.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Trading Tech

Waters Wavelength Ep. 311: Blue Ocean’s Brian Hyndman

Brian Hyndman, CEO and president at Blue Ocean Technologies, joins to discuss overnight trading.

WatersTechnology latest edition

Check out our latest edition, plus more than 12 years of our best content.

A new data analytics studio born from a large asset manager hits the market

Amundi Asset Management’s tech arm is commercializing a tool that has 500 users at the buy-side firm.

How exactly does a private-share trading platform work?

As companies stay private for longer, new trading platforms are looking to cash in by helping investors cash out.

Accelerated clearing and settlement, private markets, the future of LSEG’s AIM market, and more

The Waters Cooler: Fitch touts AWS AI for developer productivity, Nasdaq expands tech deal with South American exchanges, National Australia Bank enlists TransFicc, and more in this week’s news roundup.

Inside the company that helped build China’s equity options market

Fintech firm Bachelier Technology on the challenges of creating a trading platform for China’s unique OTC derivatives market.

Experts say HKEX’s plan for T+1 in 2025 is ‘sensible’

The exchange will continue providing core post-trade processing through CCASS but will engage with market participants on the service’s future as HKEX rolls out new OCP features.

‘The opaque juggernaut’: Private credit’s data deficiencies become clear

Investor demand to take advantage of the growing private credit markets is rising, despite limited data, trading mechanisms, and a lack of liquidity.