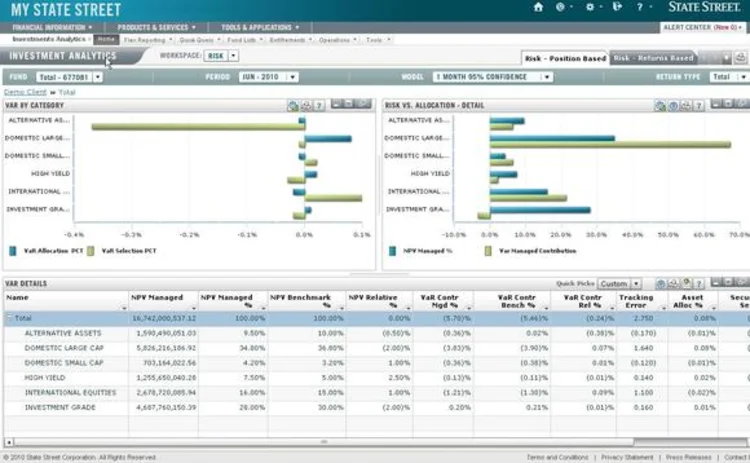

State Street Adds Stress Tests to Risk Dashboard

State Street officials announced today that they have added enhancements to its dashboard to help clients better manage risk and compliance. This is the third major upgrade of the State Street Investment Analytics Dashboard since its introduction in the autumn of 2008.

"One of the key features that our clients are looking for is a consolidated delivery of all their regulatory and investment management needs," Ash Tahbazian, vice president, State Street Investment Analytics, tells Sell-Side

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Trading Tech

Overbond’s demise hints at cloud-cost complexities

The fixed-income analytics platform provider shuttered after failing to find new funding or a merger partner as costs for its serverless cloud infrastructure “ballooned.”

Pico’s IntelliVUE brings observability to its networks

Leveraging its 2019 acquisition of Corvil Analytics, Pico is providing users with real-time oversight and monitoring of their connectivity.

Technical and regulatory questions surround Europe’s T+1 move

The EU roadmap mirrors the UK’s goal of an October 2027 move. With more than two years to prepare, firms must consider how to implement the non-prescriptive guidelines and weigh where to automate.

Academic warns of systemic risk from AI-powered trading

Strategies generated by LLMs exhibit “very strange, correlated trading behavior”, says Lopez Lira.

The Model Context Protocol brings agents to life—along with risk

Waters Wrap: From chat to infrastructure modernization, Anthropic’s MCP offers a ‘bridge’ to agentic AI, but its early days may prove disillusioning.

NZX outlines plans to bolster fast-growing dark pool

Since launching one year ago, NZX’s dark book has 5.5% of the exchange’s total turnover, and price improvement per trade on average is 11 basis points, but the exchange has more in store.

Agentic AI comes to Bloomberg Terminal via Anthropic protocol

The data giant’s ubiquitous terminal has been slowly opening up for years, but its latest enhancement represents a forward leap in what CTO Shawn Edwards calls, “the way we should talk to the world.”

M&G Investments braves cost headwinds in pursuit of AI

The UK asset manager’s AI ambitions started with the creation of a data lake to ensure high-quality data is being fed into models.