Millisecond

Launch of Deutsche Börse’s midpoint dark pool delayed

The exchange group faces a roadblock as it awaits a reference price waiver from its regulator.

Has cloud cracked the multicast ‘holy grail’ for exchanges?

An examination of how exchanges—already migrating to the cloud—are working to solve the problem of multicasting in a new environment.

Smashing barriers: How shortwave frequencies are making trading firms faster

Improvements in shortwave radio frequencies could be a leap forward in the latency race. But given the costs and technical challenges, is it worth the investment?

SEC deadline raises existential questions for US market data

This month, the commission must decide on a fee filing under its market data modernization efforts. Jo wonders how likely we are to see those efforts materialize any time soon.

Waters Wrap: Mid-tier market data providers look to reinvent themselves

Anthony loves when his opinions spark debate. Following responses to a recent column on consolidation among mid-market data technology vendors, he provides something of a case study, which looks at how Exegy is evolving after its acquisition of Vela.

IHS Markit soft launches more Risk Bureau capabilities ahead of Libor transition

The newly-acquired data giant targets the sell side with a suite of new risk-based applications meant to help banks with the transition from Libor, which is expected for the end of this year.

Has Covid stopped the clocks on FX timestamp efforts?

Budget reallocation may not be the only factor stalling standardization progress, say market participants.

Not so Fast: SEC’s SIP Rule Speeds Ahead, But Faces Bumpy Road

Jo is skeptical that the SEC’s finalized market data infrastructure rule will make the public market data feeds faster.

Science Friction: Some Tire of Waiting for Quantum’s Leap

Use cases for quantum computing are piling up—from CVA to VAR. But so are the obstacles

IEX Makes Expansion Bid as New Limit Order is Approved

The Investors Exchange is now looking to propose a second new order type for NBBO non-mid liquidity.

Trading Venues Face Resilience Test in Covid-19 Pandemic

Software testing and monitoring keeps market infrastructure a step ahead amid market volatility.

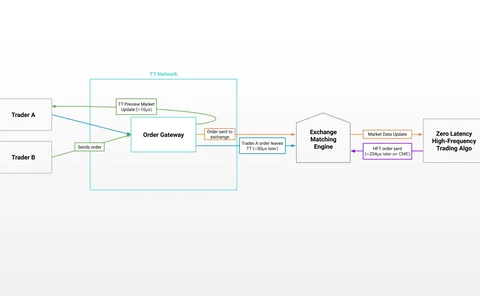

Trading Technologies Unveils New Futures Market Data Feed

As the fight over market data fees in the futures market heats up, the Chicago-based trading platform provider is rolling out a new platform that provides a free view of market order flow for TT platform users.

Bad Clocks Block FX Best-Ex

To get a good deal in fast-moving FX markets, buy-side firms need to know the time. Some of them don’t.

UBS Explores AI for Trading Functions, Real-Time Transcriptions

The investment bank is completing a proof-of-concept with Cloud9, aiming to automate front-office functions.

Warrants Issuers Battle Algo Predators in Hong Kong

The threat of high-frequency traders have forced banks to spend big on tech.

SEC’s Redfearn: US-Style Consolidated Tapes Won’t Solve Trading Data Needs

As European market participants bemoan the lack of a consolidated tape, a senior SEC executive debunks the idea that a pan-European tape, similar to the US, will resolve issues around data access and costs.

5G Networks: Information Overload

Despite what some wireless carriers say, we’re still a few years away from a mass rollout of true 5G networks. While they will be revolutionary, right now it’s more hype than reality. WatersTechnology tries to look ahead to see how capital markets firms…

Waters 25: A Look Back on the Last Two Decades

Waters examines some of the most important events in financial technology of the past 25 years.

Exegy, FIF Reboot MarketDataPeaks.com with Capacity Info

Exegy and FIF relaunch MarketDataPeaks.com using upgraded Exegy technology to bring greater accuracy and precision to real-time market data monitoring.

GDAX Releases Framework for New Digital Assets

Digital currency exchange sets out criteria for admitting cryptocurrencies to trading.