Indexes

Tariffs, data spikes, and having a ‘reasonable level of paranoia’

History doesn’t repeat itself, but it rhymes. Covid brought a “new normal” and a multitude of lessons that markets—and people—are still learning. New tariffs and global economic uncertainty mean it’s time to apply them, ready or not.

TMX’s indexing pivot bears first fruit

The acquisition of index provider VettaFi has boosted revenues in the exchange’s analytics division, but further growth could mean taking on the heavyweight data providers like S&P, FTSE Russell, and MSCI.

The IMD Wrap: Déjà vu as exchange data industry weighs its options

Max highlights some of WatersTechnology’s recent reporting on data costs and capacity issues facing the options industry, and asks, haven’t we seen this before somewhere?

The coming AI revolution in QIS

The first machine learning-based equity indexes launched in 2019. They are finally gaining traction with investors.

Price gouging? New study finds market data providers consistently inconsistent in pricing, discounts

As the industry awaits the FCA’s findings from its Wholesale Market Data Study, end-users pin their hopes on the prospect of relief. But a new study from Substantive Research details the enormous pricing disparities that must be tackled.

Quant shop preps NLP-powered index for physical climate risk

Sharp rise in extreme weather events prompts PGIM Quant to aim for better climate-risk pricing

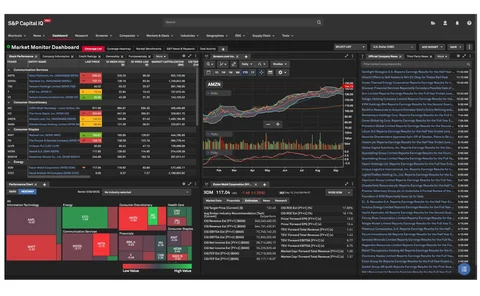

S&P tests ‘ChatIQ’ genAI search tool in revamped CapIQ desktop

The new tool is the culmination of integrating recent acquisitions, including IHS Markit, ChartIQ and Kensho.

ASX, SGX earnings driven by diversified revenue

After the Chess disaster, ASX focuses on rebuilding confidence, while SGX continues investing in its derivatives business. Meanwhile, HKEx mulls data play.

TMX, CanDeal strike deal for Canadian benchmark transition

Canada is one of many countries moving away from opinion-based benchmarks like Libor in favor of alternatives based on observable trade data. TMX and CanDeal are working to deliver a new rate which will take over as Canada’s official loan benchmark next…

As ESG investing faces headwinds, MSCI’s CEO says ESG ‘most popular’ topic for clients

For future analytics enhancements, the vendor will also lean into large language models and generative AI.

US Libor cessation: DTCC helps fill the void

In the run-up to the transition from Libor to an alternative reference rate at the beginning of July this year, DTCC’s Ann Marie Bria looks at the various permutations impacting market participants and the role DTCC is playing in helping firms navigate…

Market data consumers buy the same products at massively different price points

A new study finds that asset managers are paying several times more than their peers for the same services—but why? And can it be fixed? Does it need to be?

Index fees fatigue: Regulators, startups move in on the big 3 providers’ $5 billion business

Users of index data often complain about the fees they have to fork out, particularly to the likes of S&P, FTSE Russell, and MSCI. WatersTechnology examines the state of the industry and what will disrupt the status quo.

LSEG’s Refinitiv to deliver Real-Time Full Tick data on the cloud in 2023

The data vendor has 19 points of presence from where it will provide co-located access to the new managed services by Q2 2023.

Chill winds blow for Capitolis’s equity swap platform

The fintech’s effort to revive off-balance-sheet funding runs into market and regulatory turbulence.

Is disruption finally coming for the index business?

Regulatory developments and startups gaining some ground may—one day—threaten the incumbent providers in this space.

This Week: Microsoft/CaixaBank, Bloomberg, Cboe/Morningstar & More

A summary of the latest financial technology news.

This Week: Ice, SS&C/Morningstar, Deutsche Börse/DataBP, RBC & More

A summary of the latest financial technology news.

This Week: Bloomberg, MSCI, Liquidnet & more

A summary of the latest financial technology news.

This Week: Bloomberg/Goldman Sachs, Broadridge, Rimes, and more

A summary of some of the past week's financial technology news.

Bloomberg deploys math, not AI, to blend risk management and portfolio construction

The Mac3 GRM risk solution is live for equities users, uses no AI or machine learning, and will be rolled out to more asset classes next.