Energy

Does TP Icap-AWS deal signal the next stage in financial cloud migration?

The IMD Wrap: Amazon’s deal with TP Icap could have been a simple renewal. Instead, it’s the stepping stone towards cloudifying other marketplace operators—and their clients.

BlackRock looks to predictive ESG data, rather than point-in-time

Mary-Catherine Lader says that the asset manager is building out new modeling tools to help users better understand how the decisions a company makes today can affect their performance in the future.

S&P/IHS Markit: OPIS Faces Spin-Off; Cappitech Beefs Up Regtech Frontline

Commonalities between the two firms' commodities pricing units bring them under regulatory scrutiny as they move closer to an acquisition deal. At the same time, it appears that IHS will lean into the regulatory reporting space.

Startup Hedge Fund Turns to Quantamental Analysis for ESG Products

Boston-based Changebridge Capital is using a hybrid approach to find investment opportunities in misunderstood small- and mid-cap companies.

‘Massive Land Grab’: S&P’s IHS Markit Buy Creates Data Juggernaut, But Users Fear Price Hikes

The deal reflects the broader trend of market participants pursuing scale to create true front-to-back trading and data environments, which may signal a trading platform acquisition in the future—though the IHS Markit acquisition may face regulatory…

Nasdaq Looks to Contextualize ESG Ratings

The exchange's ESG Footprint converts ESG data into everyday metrics to show investors the impact of their portfolios.

Asset Managers Fear ESG Data Disclosure Gap

Investment firms need data to meet upcoming regulatory requirements. But corporates aren't making this data available in high enough quantity or quality.

Causality Link Building Next-Gen ESG Dashboard

The research provider will release a dashboard that decouples and drills down into the E, S, and G factors of ESG.

Ion’s Broadway Deal Leaves Banks in a Bind

Barclays and Nomura among banks that had moved from Ion to rival it now controls.

Biofuels Broker SCB Eyes More Data Partnerships in 2020

After setting up a dedicated market data function last year, the broker plans to enlist more vendors to increase distribution of its data,

People Moves: Refinitiv, State Street, DTCC, Liquidnet & More

A look at some the key "people moves" from last week, including Mike Hill (pictured), who joins Compliance.ai.

Asset Managers Chase Signals in ESG Noise

Machine learning can tell stories from large datasets to drive alpha, say quants.

Heating Up: An In-Depth Look at How Investment Firms Use Carbon Data

As ESG data becomes more of a commodity, firms are struggling with how best to incorporate carbon data.

Ion’s Deal for Allegro Worries Commodity Tech Specialists

Acquisition gives Ion a near monopoly in energy trading and risk software

Fixed Income ESG Data: Materially Different

The ESG space is growing rapidly and gaining more attention, but one area that has been largely ignored by data providers is that of ESG information specific to fixed-income investors.

Lloyds CDO Maranca Departs Finance for Schneider Electric

Maranca will be responsible for executing a global data strategy at Schneider Electric.

IHS Markit Expands EDM to Non-Financial IHS Data

After expanding its EDM platform to cover the energy industry, IHS Markit now aims to apply it to data on other relevant industries from IHS..

Bitcoin Mining Has Tangible Negative Effects for Taxpayers and the Environment

Mining for one bitcoin consumes 847 kWh; processing 100,000 Visa transactions consumes 169 kWh…and the bitcoin network produces 415.14 kgs of CO2 per transaction.

ION's Openlink Acquisition Shows Deeper Strategic Moves at Work

The Openlink deal is the latest in a string of acquisitions by ION as it consolidates power in treasury, derivatives and commodities, with the help of Carlyle Group.

Chicago Code: A Profile of DRW's Seth Thomson

Seth Thomson, CIO of DRW, talks to Waters about his career, innovation and how the firm has expanded into new asset classes, including cryptocurrencies.

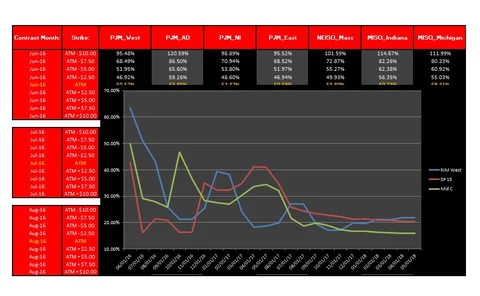

OTCGH’s EOX Expands US Implied Volatility Pricing

The expanded pricing service adds implied volatilities for new locations, as well as historical volatility and other datasets.