Government bonds

Bond CT hopeful Etrading unveils free tape prototype ahead of tenders

The vendor hopes to provide the long-awaited consolidated tape for bonds in the EU and the UK, demonstrating its ability to do so through ETS Connect.

Academics use granular data for futures market predictions

Researchers at NYU’s Courant Institute of Mathematical Sciences are using granular futures data from BMLL for research on less-covered futures markets.

Development bank aims for better settlement with blockchain prototype

R3 is among the companies working with the regional bank on a proof-of-concept to bring efficiencies to cross-border securities transactions.

Broadway Technology 2.0: Post-Ion split, the vendor reimagines its future

Broadway will look to build out its fixed income trading workflows, grow its as-a-service offering, lean into the low-code movement, while considering new asset classes to expand into—all while once again competing with Ion.

Standard Chartered, Bloomberg develop electronic workflow for Korean Treasury bonds

The workflow shortens the time it takes for investors to trade KTBs, and can be tweaked to suit other emerging bond markets.

Waters Wrap: A useful use-case for blockchain? (And Broadridge’s bond play)

While not a fan of blockchain, Anthony looks at some potential use-cases for the tool in the world of capital markets. He also gives his thoughts on Broadridge’s soon-to-launch LTX platform.)

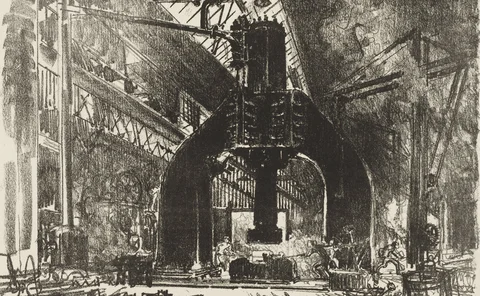

ICE ‘Bonds’ Acquisitions into Fixed-Income Powerhouse

In this profile of the Intercontinental Exchange, Lynn Martin explains how the company’s ICE Data Services unit is creating a unified offering with fixed income data at its core, after a series of acquisitions that began with its purchase of IDC in 2015.

Covid-19 Disrupts Innovation in US Treasuries Market

The pandemic has caused setbacks in electronification and streaming in the US government bonds market.

Fulcrum AM Looks to Quantify ESG Risk by Honing Hard Numbers

ESG risks will become part of investment and risk management processes across all funds at the firm.

Tradeweb Bolsters China Bond Market Access with Electronic CIBM Direct Trading Overlay

Officials say the move makes Tradeweb the only platform to offer electronic trading in Chinese bonds via two different channels.

Trading Venues Aim to Unlock Value of Green Bonds

Tech providers are looking for ways to increase liquidity in climate bonds, a tiny but fast-growing corner of the fixed-income universe.

CanDeal Unveils ‘More Accurate’ Bond Pricing Feed

The new pricing service incorporates additional inputs and uses artificial intelligence to predict price movements.

ING Setting Up Fintech Spin-Off for Bond Discovery Tool

The platform, called Katana, aims to help users find fixed income investment opportunities.

IHS Markit Considers Adding Corporate Bonds to iBoxx ChinaBond Indices

A lack of liquidity and the ability to accurately measure credit risk will be the biggest hurdles to overcome.

BrokerTec Introduces RFQ For European Repo Market

The RFQ model is part of a growing trend towards electrification in the repo markets.

IIROC Melds Equities, Debt Surveillance on Nasdaq Smarts Platform

IIROC has used Nasdaq Smarts for market surveillance since 2010, but is consolidating equities and debt market surveillance for the first time.

Tackling China’s Onshore Bond Market

An on-the-ground look at China's growing bond market and the challenges that remain for foreign investors.

Emerging Markets Exchanges Embrace New Tech

While economic measures might place markets in Kenya, Tanzania, Palestine and elsewhere firmly in the “emerging” bracket, their use of technology is anything but.

Algomi Pivots Offering Away from Honeycomb to Alfa

Usman Khan sits down with WatersTechnology to discuss how the vendor will look to change course in 2019 and focus on the development of the Alfa platform.

LiquidityEdge Names Andy Bria COO

Bria, formerly head of client services for EBS at NEX Group, will help lead the trading venue's expansion.

Thomson Reuters Data Reveals Increasing Demand for Japanese Insights

A partnership with Japan’s Quick gives global Eikon users access to equity and derivatives market commentary services.