Celent

In data expansion plans, TMX Datalinx eyes AI for private data

After buying Wall Street Horizon in 2022, the Canadian exchange group’s data arm is looking to apply a similar playbook to other niche data areas, starting with private assets.

This Week: Clear Street, AXA/AWS, TD Bank/Google Cloud and more

A summary of the latest financial technology news.

Generative AI is here to stay, even if the path forward is unclear

Chatbots and large language models dominated the AI conversation this year with the expectation that 2024 will bring more innovation and use cases to the forefront.

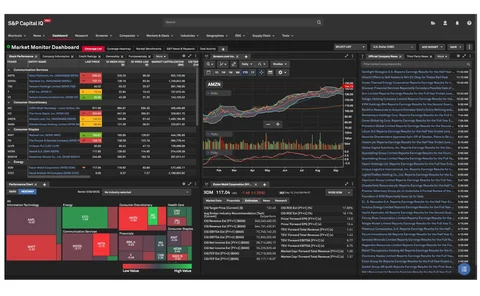

S&P tests ‘ChatIQ’ genAI search tool in revamped CapIQ desktop

The new tool is the culmination of integrating recent acquisitions, including IHS Markit, ChartIQ and Kensho.

Inside look: How Big Tech is using generative AI to win over finance

Execs from Amazon, Google and IBM explain their capital markets strategy when it comes to rolling out new AI tools.

Broadridge rethinks the OMS

Through its partnership with Glue42, Broadridge is bringing together the best components of its agency trading and market-making solutions.

New tech for corporate actions aims to improve the data extraction process

Demand for corporate actions data is increasing in the front and middle office, but the data can be hard to read.

Mainframes still mainstream: How financial markets are embracing and evolving 'legacy' IT

Tech giant IBM is targeting security, AI, and portability in the modernization of the mainframe as firms report still retaining “the workhorse of the back office.”

Waters Wrap: The buy side, the changing nature of buy v. build, and how fintech has evolved

Neal Pawar, the former CTO of AQR and current COO of Qontigo, chats with Anthony about some of the major trends that are changing how asset managers interact with the vendor community, and how this shift mirrors the most significant evolutions in capital…

New study shows mainframes still popular despite the rise of cloud—though times are changing…fast

A whitepaper from the DTCC and Celent finds that 67% of buy- and sell-side firms hope to be “cloud first” by 2024, but mainframes still part of the equation.

Bloomberg’s Aim-Port integration highlights broader industry interop push

The data giant is creating tighter back-end interoperability between its buy-side platforms and using APIs to connect with other third-party providers.

Cboe completes integrations of triple acquisition, turns focus on risk and analytics

In 2020, Cboe Global Markets acquired three businesses in rapid succession. Two years later, the tech stack integrations are complete, and the now-combined entities make up the majority of the exchange’s rebranded Risk and Market Analytics Group.

People Moves: Canoe Intelligence, Transcend, Clear Street, Gresham Technologies, and more

A look at some of the key "people moves" from this week, including Vishal Saxena (pictured), who joins Canoe Intelligence as chief technology officer.

Six corporate actions prototype aims to slash data delivery time

If the prototype is put into production, delivery of corporate actions data for dividends could be reduced from up to 24 hours to 15 to 30 minutes.

Holding Pattern: As Trading Technologies awaits new owner, the vendor adjusts development strategy

The Chicago-based futures trading platform recently rolled out a new OMS offering, while other projects, like its Echo Chamber market data platform, have been put on pause until a sale goes through.

Broadway Technology 2.0: Post-Ion split, the vendor reimagines its future

Broadway will look to build out its fixed income trading workflows, grow its as-a-service offering, lean into the low-code movement, while considering new asset classes to expand into—all while once again competing with Ion.

Small alt data providers feel pressure to specialize

GTCOM-US, once a bespoke alt data shop for the buy side, has narrowed its offering to focus on Chinese datasets as the largest alt data players get even bigger.

Linedata looks to modularize OMS, analytics offerings to compete in consolidating market

After releasing its cloud-native AMP and data analytics platforms in 2020, Linedata is looking to readjust its OMS strategy as it embraces microservices.

The embrace of buy-side interoperability: State Street, SimCorp team up

The partnership between the two major players in the buy-side technology space reflects the shift in how rivals do business.

ICE ‘Bonds’ Acquisitions into Fixed-Income Powerhouse

In this profile of the Intercontinental Exchange, Lynn Martin explains how the company’s ICE Data Services unit is creating a unified offering with fixed income data at its core, after a series of acquisitions that began with its purchase of IDC in 2015.

‘Massive Land Grab’: S&P’s IHS Markit Buy Creates Data Juggernaut, But Users Fear Price Hikes

The deal reflects the broader trend of market participants pursuing scale to create true front-to-back trading and data environments, which may signal a trading platform acquisition in the future—though the IHS Markit acquisition may face regulatory…