The future of algo trading: Using deep learning to more accurately predict equity market volumes

OpEd by Sam Clapp, Mizuho Americas equities, and Don Hundley, Japan head of Mizuho equities electronic trading

Trading algorithms are continuing to gain traction among the buy side, with respondents to a recent report indicating they are using automated tools more than ever. It is further validation of their increasing sophistication and wider acceptance, but the trend is highly concentrated. On average, the largest buy-side firms assign 33% of their order flow to their top provider, according to the report.

But that does not mean they are limiting their choices. Bloomberg Intelligence found these big firms added an average of two additional providers since 2018, bringing the roster of electronic brokers to nearly 12 each. Clearly, getting to the top and staying there is of paramount importance.

That’s creating a new arms race among providers to develop algorithms that use artificial intelligence to understand, or even anticipate, market conditions. Increasingly fragmented and complex market conditions help fuel the constant competition for creating the next innovation that will make electronic trading more agile and effective.

AI can be viewed as more of a marketing buzzword in the electronic trading world, covering a range of different types of algorithms and technologies. However, recent efforts, including those from Mizuho Group’s AI research team, are focused on applying cutting-edge science to the real-world conditions of the financial markets to develop algorithms that are smarter, more adaptable—and most importantly, that add value to trading operations.

Pushing deep learning into volume prediction

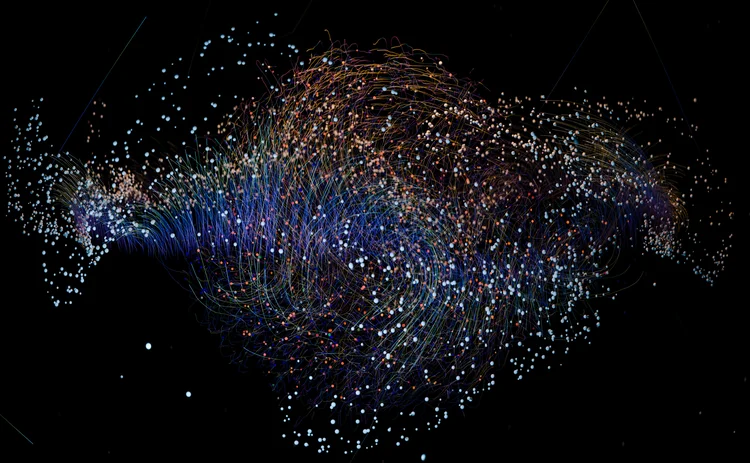

Central to achieving these goals is a type of AI called deep learning, used to create algorithms that help execute trades more efficiently and effectively. Deep learning, which is used in Mizuho’s Compass trading algorithm, has proven to be especially effective for financial applications, because it can process huge amounts of data—such as historical market conditions or stock price movements—to identify patterns and determine actions to take based on those conditions.

Of course, price is only one of the variables that traders consider when executing trades. In partnership with AI experts from Peking University, Dr. Ruhan Bao, who leads the Mizuho research team and helped to pioneer the use of deep learning for stock price prediction in Mizuho’s Compass trading algorithm, have been exploring the application of a deep learning technique called “clustering analysis” to handle the kind of real-time judgments that trading desks face every day.

Clustering allows for the examination of characteristics such as volume profile, volatility profile, and liquidity to categorize stocks into like groups. It then analyzes historical data to find the most effective way to trade those stock clusters based on the clients’ benchmark, including adjusting the appropriate amount to trade in the open auction, whether to passively post in the exchange, the exposure given to the dark pool at any given time/price point, and the level of intensity in trading blocks of liquidity that appear on the order book.

To build on the benefits of price prediction and clustering requires the development of a new method for volume prediction to help traders further manage changing market conditions. Think of the rise in passive investing, and what happens to stock volume when indexes are reconstituted. A traditional algorithm might suggest trades based on historic volume profiles, which won’t be ideal on an index event day. But an algorithm with machine learning-enabled volume prediction could study trading volume on all past index event days, detect the patterns, and predict the volume on the next index event day and recommend trades accordingly.

This AI breakthrough caught the attention of the sponsors of the 2021 International Joint Conference on Artificial Intelligence. Dr. Bao and members of the Peking University team were invited to present their paper on volume prediction as part of the conference’s main track in August.

Moving from the research department to the trading desk

While the AI-research community has recognized the importance of new volume prediction capabilities, the most important validation will come from traders who benefit from this new technology. Further incorporation of volume prediction in trading algorithms is expected to help further minimize trading costs. For example, since creating Compass in 2019, we’ve measured a 31.2% improvement in performance versus arrival price, which only inspired us to look for other ways to further improve the algorithm using AI.

This kind of continual research and innovation has helped electronic trading become entrenched in today’s financial markets. And with the kind of breakthroughs that we’ve already seen from AI, we expect that electronic trading will only become a more essential—and powerful—tool for financial institutions in the future.

By Sam Clapp, Mizuho Americas equities, and Don Hundley, Japan head of Mizuho equities electronic trading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

As trading firms embrace AI, so do hackers

According to a Google cybersecurity report, cybercriminals are turning to AI to sharpen their attacks.

AI & data enablement: A looming reality or pipe dream?

Waters Wrap: The promise of AI and agents is massive, and real-world success stories are trickling out. But Anthony notes that firms still need to be hyper-focused on getting the data foundation correct before adding layers.

Waters Wavelength Ep. 343: Broadridge’s Jason Birmingham

This week, Jason Birmingham of Broadridge talks with Tony about the importance of fundamentals as technology rapidly evolves.

Data standardization is the ‘trust accelerator’ for broader AI adoption

In this guest column, data product managers at Fitch Solutions explain AI’s impact on credit and investment risk management.

BNY inks AI deal with Google, Broadridge moves proxy voting to AWS, Expero delivers ICE market data, and more

The Waters Cooler: TSX Venture Exchange data hits the blockchain, SmartTrade acquires Kace, and garage doors link to cloud costs in this week’s news roundup.

Everyone wants to tokenize the assets. What about the data?

The IMD Wrap: With exchanges moving market data on-chain, Wei-Shen believes there’s a need to standardize licensing agreements.

Google, CME say they’ve proved cloud can support HFT—now what?

After demonstrating in September that ultra-low-latency trading can be facilitated in the cloud, the exchange and tech giant are hoping to see barriers to entry come down.

Waters Wavelength Ep. 342: LexisNexis Risk Solutions’ Sophie Lagouanelle

This week, Sophie Lagouanelle, chief product officer for financial crime compliance at LNRS, joins the podcast to discuss trends in the space moving into 2026.