Blockchain Frameworks Move Forward with Partnerships and Production Releases

Hyperledger Fabric has released its production-ready version 1.0, as R3 partners with Intel

Hyperledger has made Hyperledger Fabric 1.0 available for the development of applications, products and solutions on an open-source basis.

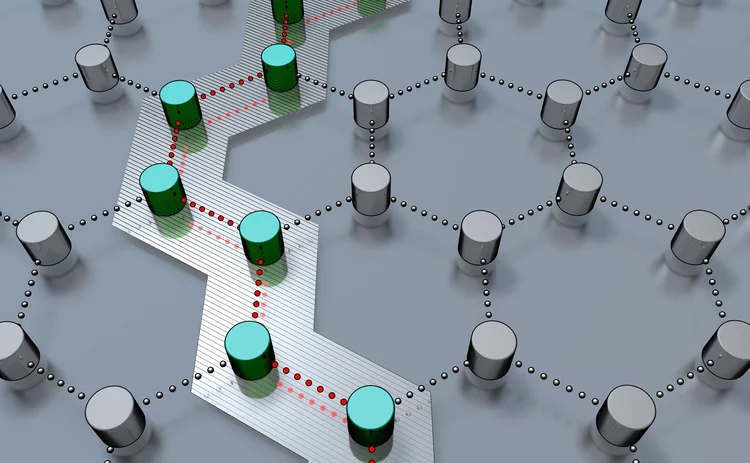

Hyperledger Fabric—hosted by The Linux Foundation—offers modular architecture for plug-and-play components, and leverages smart contracts it calls “chaincode” for the system’s application logic. The technology was incubated 16 months ago and placed on active status in March 2017.

Brian Behlendorf, executive director of Hyperledger, said the release of the technology is a milestone for distributed-ledger technology.

“After over a year of public collaboration, testing, and validation in the form of proof of concepts and pilots, consumers and vendors of technology based on Hyperledger Fabric can now advance to production deployment and operations,” Behlendorf. “I look forward to seeing even more products and services being powered by Hyperledger Fabric in the next year and beyond.”

The technology was developed by engineers from the Hyperledger community which includes CLS, the Depository Trust and Clearing Corporation (DTCC), Digital Asset, GE, the Linux Foundation, State Street, IBM, and SAP. In total, around 159 developers worked on the project.

Several Hyperledger community members have already begun using Hyperledger Fabric for their applications. CLS, for example, announced in September last year that it intends to develop a payments-netting service on Hyperledger Fabric and ANZ Banking Group is running a proof of concept to digitize guarantees for property companies.

“As a founding member of the Hyperledger community, ANZ is excited to be using Hyperledger Fabric 1.0 in its latest customer proof-of-concept, which has enabled the digitization of the bank guarantee, or standby letter of credit as they are known in the US, for property companies in Australia,” said Nigel Dobson, general manager for wholesale digital and digital banking at ANZ Banking Group, in an accompanying statement

Separately, R3 announced it is collaborating with Intel to strengthen data privacy and security for its own blockchain framework, Corda, which entered into public beta in June.

The collaboration adds elements of Intel’s security and privacy toolkit for Corda’s need-to-know feature, which assures confidentiality in trades by selectively sending information to parties who require it.

R3’s lead platform engineer Mike Hearn said the consortium is continually working on solutions to better protect privacy on the ledger.

“By partnering with Intel, we will be able to give Corda users more class-leading features as we continue to set the standard in distributed ledger technology data privacy,” Hearn said in a statement. “Corda addresses multiple problems identified by our 80-plus members across the globe but transaction privacy is usually the top issue blocking real-world deployment.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Trading Tech

Tariffs, data spikes, and having a ‘reasonable level of paranoia’

History doesn’t repeat itself, but it rhymes. Covid brought a “new normal” and a multitude of lessons that markets—and people—are still learning. New tariffs and global economic uncertainty mean it’s time to apply them, ready or not.

ICE eyes year-end launch for Treasury clearing service

Third entrant expects Q2 comment period for new access models that address ‘done-away’ accounting hurdle

MarketAxess, S&P partnership aims for greater transparency in fixed income

CP+, MarketAxess’s AI-powered pricing engine, will receive an influx of new datasets, while S&P Global Market Intelligence integrates the tool into its suite of bond-pricing solutions.

Trading Technologies looks to ‘Multi-X’ amid vendor consolidation

The vendor’s new CEO details TT’s approach to multi-asset trading, the next generation of traders, and modern architecture.

Waters Wavelength Ep. 311: Blue Ocean’s Brian Hyndman

Brian Hyndman, CEO and president at Blue Ocean Technologies, joins to discuss overnight trading.

WatersTechnology latest edition

Check out our latest edition, plus more than 12 years of our best content.

A new data analytics studio born from a large asset manager hits the market

Amundi Asset Management’s tech arm is commercializing a tool that has 500 users at the buy-side firm.

How exactly does a private-share trading platform work?

As companies stay private for longer, new trading platforms are looking to cash in by helping investors cash out.