Mobility Webcast: Anytime, Anywhere

LISTEN TO THE ARCHIVED WEBCAST NOW

The availability of information at fingertips, accessible at a moment’s notice, has transformed modern society. The financial services sector may have been slow to adopt mobile as an operational strategy in its own right—largely because of regulatory requirements and security concerns—although the way in which we all expect to operate on a mobile basis has nevertheless begun to filter through to all facets of the industry.

Waters recently assembled a panel of experts from third-party mobile providers and buy-side firms to discuss the effect that this is having on modern trading operations, and the ways in which it will evolve in the future. Panelists included Anthony Vigilante, managing director and head of IT at MacKay Shields; Stephen Hart, director of technology infrastructure at Lord Abbett and Co.; and Breck Parkinson, enterprise tablet segment marketing manager in the mobile and communications group at Intel. James Rundle moderated the discussion.

Consumer Seeds

While the concerns of the consumer market and the financial services industry may be very different, the panelists say the way in which we interact with technology and information outside of work has influenced our expectations of how we should be able to do that in a professional manner.

“People want access from anywhere and at any time—that’s the world we live in,” explains Intel’s Parkinson.

“Users are expecting to be able to do more and more,” says MacKay Shields’ Vigilante. “It started off with checking e-mails, calendars and contacts a few years back, but it’s really transformed to a point where I want to be able to do practically everything that I can in the office while on the road. To take that one step further, I also want to be able to do that from any device I choose, whether it’s on an Apple iPad or iPhone, a BlackBerry, or whatever.”

Suitability and Complexity

Lord Abbett’s Hart explains, however, that every device enabled for mobile increases the density of an IT infrastructure. Devices are traditionally managed through mobile device management (MDM) software, but idiosyncratic hardware such as BlackBerrys will require their own systems in the form of enterprise servers. In addition to the software angle, regulations around communications recording add another layer, according to Hart.

“We have to capture communications, and they all have to be retained for seven years,” he says. “While enabling mobile devices, we found the complexity of our environment becoming exponentially greater. Each of these platforms is unique and particular to itself in many ways, there are a lot of products that you have to integrate, and finally, to bring all of the information in has caused a lot of extra work in meeting the regulatory bar.”

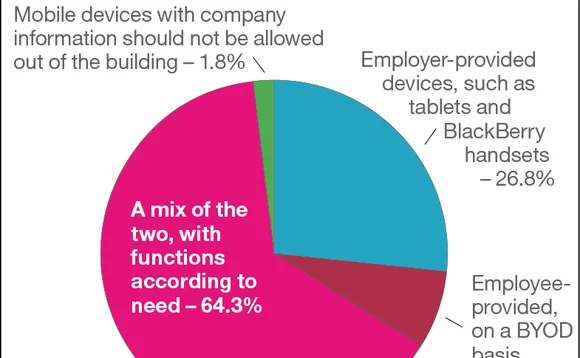

Both MacKay Shields and Lord Abbett have implemented bring-your-own-device (BYOD) policies, but this hadn’t lessened the technology burden, or the requirement for MDM processes. The most important factor, both say, is having a firm-usage policy in place. One of the dangers with BYOD when it interfaces with regulatory requirements is the potential to breach data privacy requirements, so having employees understand the need to separate the personal and professional environments where possible is crucial.

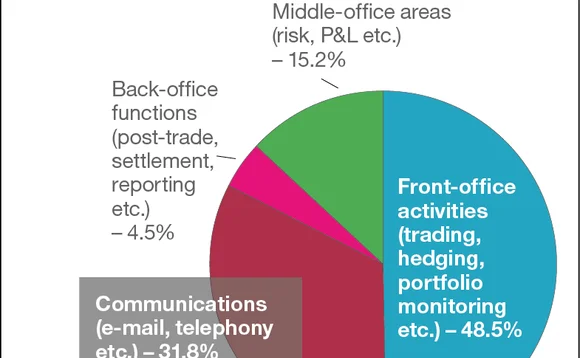

Sales personnel are currently the biggest users of mobile within firms, according to the panelists, because these employees are frequently on the road. For trading, both Vigilante and Hart say mobile allows for decisions to be made using available data, but that trade orders are still phoned in to the office.

Security for Securities

There are a number of issues impeding full adoption of mobile devices, however. One is the perennial question of security, which can range from hackers operating on public Wi-Fi access, through to lost devices. The panelists say there is no single solution that satisfactorily addresses their concerns.

“We’re looking at a two-factor authentication solution, but there aren’t any silver bullets out there,” Hart explains. “We’re having to look at multiple products.”

Other concerns center on the platforms themselves for which software is developed. While devices running Apple’s iOS mobile operating system (OS) are pervasive, at least among workforces and clients in financial services, the wider trends in the mobile market are tending toward smartphones and tablets that run on the rival Android OS. Recent figures from Google, for instance, place the number of daily Android activations at 1.5 million. While platform-agnostic languages such as HTML5 are emerging, both end-user participants say they are adopting a wait-and-see approach, which is inhibiting serious development.

Disaster Recovery

All of the panelists agree that mobility is no longer an option as an avenue to pursue, but essential to any effective operation. This was highlighted, in part, by natural disasters such as Hurricane Sandy in the US last year, when areas of Manhattan were rendered impassable by the storm.

“All of the things that have happened in the past few years have made it a huge concern, and having the ability to maintain business continuity and access to data on any device is extremely important. Mobility is a huge part of that,” says Intel’s Parkinson.

However, just because an infrastructure is mobile doesn’t mean it should be the only component of a business contingency strategy. Lord Abbett’s Hart points to his experiences during Sandy from Jersey City, explaining that it was possible for employees to work remotely, although many didn’t have the physical ability to do so.

“We had our generator up and our building was intact, but it doesn’t much matter if you don’t have gas and can’t drive anywhere,” he says. “We had our disaster recovery site up, but physical mobility was severely limited. Sandy taught us that you can’t assume you’ll have gas, or that people will be able to get from point A to point B.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Trading Tech

Waters Wavelength Ep. 311: Blue Ocean’s Brian Hyndman

Brian Hyndman, CEO and president at Blue Ocean Technologies, joins to discuss overnight trading.

WatersTechnology latest edition

Check out our latest edition, plus more than 12 years of our best content.

A new data analytics studio born from a large asset manager hits the market

Amundi Asset Management’s tech arm is commercializing a tool that has 500 users at the buy-side firm.

How exactly does a private-share trading platform work?

As companies stay private for longer, new trading platforms are looking to cash in by helping investors cash out.

Accelerated clearing and settlement, private markets, the future of LSEG’s AIM market, and more

The Waters Cooler: Fitch touts AWS AI for developer productivity, Nasdaq expands tech deal with South American exchanges, National Australia Bank enlists TransFicc, and more in this week’s news roundup.

Inside the company that helped build China’s equity options market

Fintech firm Bachelier Technology on the challenges of creating a trading platform for China’s unique OTC derivatives market.

Experts say HKEX’s plan for T+1 in 2025 is ‘sensible’

The exchange will continue providing core post-trade processing through CCASS but will engage with market participants on the service’s future as HKEX rolls out new OCP features.

‘The opaque juggernaut’: Private credit’s data deficiencies become clear

Investor demand to take advantage of the growing private credit markets is rising, despite limited data, trading mechanisms, and a lack of liquidity.