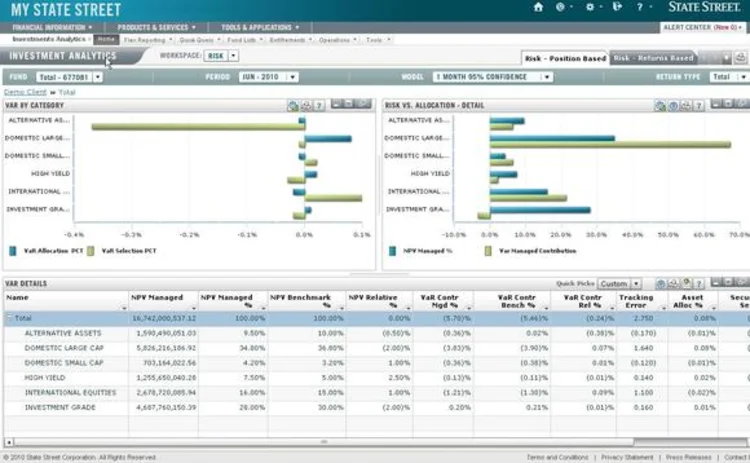

State Street Adds Stress Tests to Risk Dashboard

State Street officials announced today that they have added enhancements to its dashboard to help clients better manage risk and compliance. This is the third major upgrade of the State Street Investment Analytics Dashboard since its introduction in the autumn of 2008.

"One of the key features that our clients are looking for is a consolidated delivery of all their regulatory and investment management needs," Ash Tahbazian, vice president, State Street Investment Analytics, tells Sell-Side

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Trading Tech

Overnight trading blocked, consolidated tapes, BlackRock’s Larry Fink, data costs, and more

The Waters Cooler: Deutsche Börse provides crypto custody, FIS has a new GenAI tool, and some M&A activity in this week’s news round-up.

Johannesburg Stock Exchange releases new order routing service to lower trading costs

The exchange collaborated with Rapid Addition for its creation.

DLT and digital contracts for market data: Has the hammer found the nail?

Waters Wrap: A new platform that a custom-made DLT underpins is coming to market. Anthony examines its merits and, surprisingly, finds a lot.

No, no, no, and no: Overnight trading fails in SIP votes

The CTA and UTP operating committees voted yesterday on proposals from US exchanges to expand their trading hours and could not reach unanimous consensus.

Bond CT hopeful Etrading unveils free tape prototype ahead of tenders

The vendor hopes to provide the long-awaited consolidated tape for bonds in the EU and the UK, demonstrating its ability to do so through ETS Connect.

Jump Trading CIO: 24/7 trading ‘inevitable’

Execs from Jump, JP Morgan, Goldman Sachs, and the DTCC say round-the-clock trading—whether five or seven days a week—is the future, but tech and data hurdles still exist.

Terry Duffy on CME’s cloud future, takeover targets, and ... candy

CME CEO Terry Duffy explains the relatively narrow strategy that the derivatives exchange has taken under his leadership, especially compared to its peers.

Big Tech and capacity issues, Bridgewater’s CEO on AI, the UK’s Pisces platform, and more

The Waters Cooler: AI and cloud—shockingly—were major talking points this week…as they were the weeks before, and likely the weeks to come.