DelphX Plans Expansion, Data on Quandl

Launched in 2013, the pricing service currently provides fair value prices for 25,000 corporate bonds—90 percent of which trade infrequently—by analyzing historical trade data going back to 2002, sourced from the Financial Industry Regulatory Authority’s Trade Reporting and Compliance Engine feed.

Mav=n groups securities into different groups (aka “cohorts”) with similar attributes, such as maturity lengths, and analyzes each bond’s historical price movements relative to those in its cohort. Mav=n can then predict the price of illiquid bonds based on the price movements of other related bonds that have traded. The vendor also provides users with an accuracy score based on the deviation between Mav=n’s predicted price and the next actual traded price.

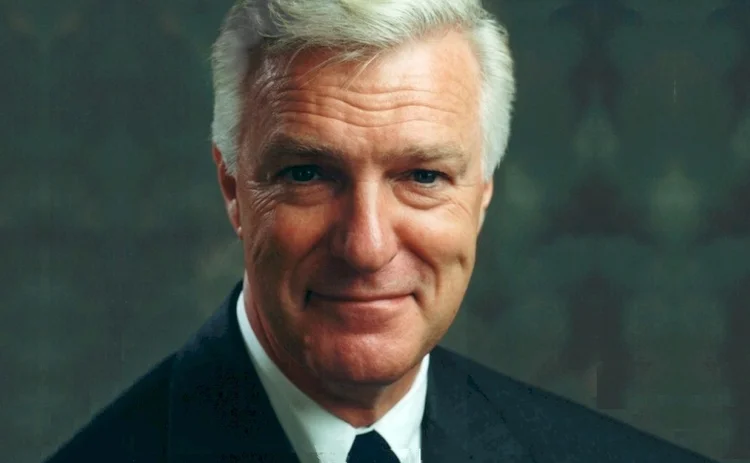

Over 2015, DelphX plans to expand the service to 144A asset private placements, and asset-backed and mortgage backed securities. The vendor also plans to add coverage of municipal bonds, but due to the complexity and size of the municipal bond market, these prices are unlikely to be available until 2016, says DelphX founder, president and chief executive Larry Fondren.

“Municipals are a different market. There are 25,000 corporate bonds, but there are 1.2 million rated municipal bond issues out there, and it’s twice that number if you count unrated issues. But we are working on it now,” Fondren says.

Content on Quandl

Separately, DelphX is currently adding its Mav=n end-of-day corporate bond prices to Toronto-based economic and financial search engine Quandl’s financial and economic online database, to provide historical bond data to a wider base of retail and institutional traders.

Currently, the vendor distributes real-time Mav=n values via Thomson Reuters’ Elektron feed, and now will distribute end-of-day prices via Quandl for 25,000 corporate bonds, as well as historical data covering every transaction related to each security going back to 2006 or whenever a bond was issued. In response to requests from Quandl clients, DelphX may also extend the deal to include intraday prices every 30 minutes to cater to users such as institutional investors or bond exchange-traded funds that require prices closer to real-time.

The two vendors are currently finalizing the commercials of the deal, but the data will be significantly cheaper than accessing end-of-day bond prices via current incumbent providers, Fondren says. “If you are… only buying end-of-day pricing, it’s a whole lot easier and a whole lot cheaper to use our values through Quandl.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

Standard Chartered goes from spectator to player in digital asset game

The bank’s digital assets custody offering is underpinned by an open API and modular infrastructure, allowing it to potentially add a secondary back-end system provider.

Saugata Saha pilots S&P’s way through data interoperability, AI

Saha, who was named president of S&P Global Market Intelligence last year, details how the company is looking at enterprise data and the success of its early investments in AI.

Data partnerships, outsourced trading, developer wins, Studio Ghibli, and more

The Waters Cooler: CME and Google Cloud reach second base, Visible Alpha settles in at S&P, and another overnight trading venue is approved in this week’s news round-up.

Are we really moving on from GenAI already?

Waters Wrap: Agentic AI is becoming an increasingly hot topic, but Anthony says that shouldn’t come at the expense of generative AI.

Cloud infrastructure’s role in agentic AI

The financial services industry’s AI-driven future will require even greater reliance on cloud. A well-architected framework is key, write IBM’s Gautam Kumar and Raja Basu.

Waters Wavelength Ep. 310: SigTech’s Bin Ren

This week, SigTech’s CEO Bin Ren joins Eliot to discuss GenAI’s progress since ChatGPT’s emergence in 2022, agentic AI, and challenges with regulating AI.

Microsoft exec: ‘Generative AI is completely passé. This is the year of agentic AI’

Microsoft’s Symon Garfield said that AI advancements are prompting financial services firms to change their approach to integrating AI-powered solutions.

Inside the company that helped build China’s equity options market

Fintech firm Bachelier Technology on the challenges of creating a trading platform for China’s unique OTC derivatives market.