Thomson Reuters 'Fast Forwards' from Glocer to Smith

Less than six months after a reorganization and cull of senior executives, Thomson Reuters announced on Thursday that chief executive Tom Glocer will depart the vendor at the end of this year, to be replaced by former Thomson Corp. veteran and current chief operating officer Jim Smith, as part of an organizational restructure that will see the company reorganized into five business divisions.

Glocer, who joined the vendor in 1993 as deputy general counsel before becoming president of Reuters Latin America and Reuters America, then CEO of Reuters in 2001 and CEO of Thomson Reuters following the acquisition of Reuters by Thomson Corp. in 2008, will “retire” from his role and the Thomson Reuters board on Dec. 31, according to a statement.

The new divisional structure sees the creation of a Financial and Risk division, to be led by David Craig, currently president of the vendor’s Governance Risk and Compliance business, and a Global Growth Organization, to be led by Shanker Ramamurthy, currently head of the vendor’s Financial Professionals and Marketplaces business, which combined the former Sales & Trading and Investment & Advisory units earlier this year. The other divisions are Legal, Intellectual Property & Science, and Tax & Accounting.

The move is the latest in a series of high-level changes at Thomson Reuters designed to “flatten” its structure, simplify its business model, create synergies and accelerate growth, which included letting go a swathe of senior executives earlier this year, including Devin Wenig, then-CEO of the vendor’s Markets division, which comprised its financial data and news business (IMD, July 22). Following the departures, Glocer took on overall responsibility for the Markets division.

Glocer is credited with turning around Reuters with his “Fast Forward” cost-cutting initiative following a historic net loss after taking the reins (IMD, Feb. 24, 2003), and was twice named Executive of the Year in the Inside Market Data Awards. But sources say Glocer had increasingly come under pressure from the Thomson family—which still owns a majority stake in the vendor via its family trust, The Woodbridge Company—to increase revenues at the vendor, whose new flagship desktop Eikon has struggled to gain traction against rival Bloomberg, and that it had recently appeared that Smith was being groomed to take the reins as CEO. The vendor’s share price has fallen from highs of nearly $42 in February to $26.88 at close on Thursday.

A Thomson Reuters spokesperson cites the vendor’s third quarter results, where it reported 32,000 Eikon sales—including 27,000 migrations and 5,000 new positions, with 8,000 active users—but declines to comment further on the changes.

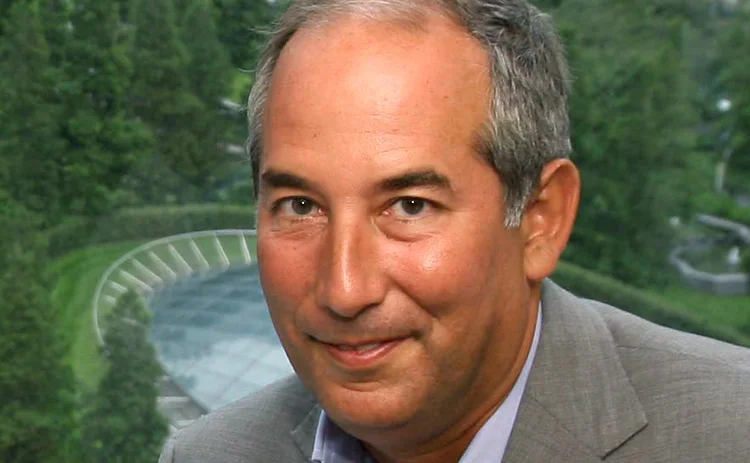

Smith, who takes over as CEO on Jan. 1, joined Thomson Newspaper Group in 1987, rising to head of operations for the US prior to the Newspaper Group’s sale in 2000. He then joined Thomson Corp. as executive vice president, ultimately becoming CEO of Thomson Corp. and then CEO of Thomson Reuters’ Professional division, which comprised the former Thomson Corp.’s legal, tax and accounting, scientific and education businesses.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

Editor’s Picks: Our best from 2025

Anthony Malakian picks out 10 stories from the past 12 months that set the stage for the new year.

The next phase of AI in capital markets: from generative to agentic

A look at some of the more interesting projects involving advanced forms of AI from the past year.

Market data costs defy cyclicality

Trading firms continue to grapple with escalating market data costs. Can innovative solutions and strategic approaches bring relief?

As trading firms embrace AI, so do hackers

According to a Google cybersecurity report, cybercriminals are turning to AI to sharpen their attacks.

AI & data enablement: A looming reality or pipe dream?

Waters Wrap: The promise of AI and agents is massive, and real-world success stories are trickling out. But Anthony notes that firms still need to be hyper-focused on getting the data foundation correct before adding layers.

Waters Wavelength Ep. 343: Broadridge’s Jason Birmingham

This week, Jason Birmingham of Broadridge talks with Tony about the importance of fundamentals as technology rapidly evolves.

Data standardization is the ‘trust accelerator’ for broader AI adoption

In this guest column, data product managers at Fitch Solutions explain AI’s impact on credit and investment risk management.

BNY inks AI deal with Google, Broadridge moves proxy voting to AWS, Expero delivers ICE market data, and more

The Waters Cooler: TSX Venture Exchange data hits the blockchain, SmartTrade acquires Kace, and garage doors link to cloud costs in this week’s news roundup.