Recognos Focuses on Mutual Funds with Latest Upgrades

The New York-based firm uses machine learning, natural language processing and semantic technologies to provide context around unstructured reference data.

This latest rollout includes two new features. First, if there's a change made by a mutual fund that's filed in a Securities and Exchange Commission (SEC) document that might be important, an alert is sent to the user. Such changes include modifications to a fund's prospectus, like a statement of additional information (SAI). Each night, the system captures this information for any open-end mutual fund companies. Users can create customized alerts.

The other major upgrade "will allow fund groups or intermediaries to review and compare their data against industry data or versus select competitors down to a particular share class or CUSIP level," according to the company.

The RDC is an industry utility that serves as a central repository for documents relating to all US-based open-ended mutual funds. It uses a combination of machine learning, natural language processing and semantic technologies to create actionable information out of unstructured data.

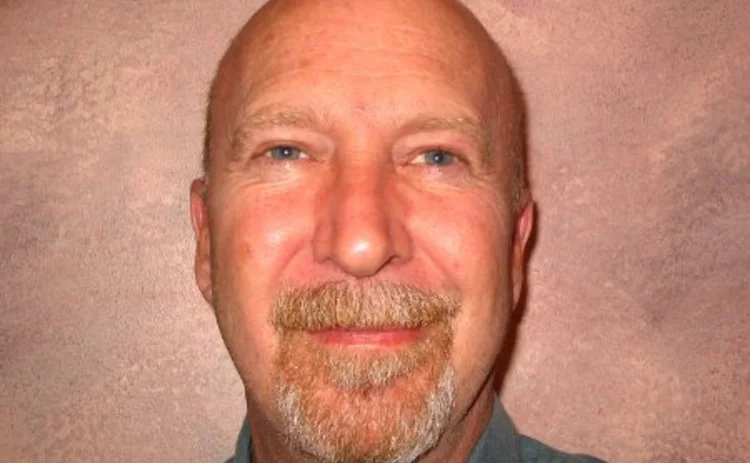

"By employing our advanced machine learning and natural language processing techniques to extracting data from SEC filings, Recognos Financial is unlocking additional analytical value for investors, asset managers and mutual fund providers on a timely basis," said Drew Warren, president and CEO, in a statement.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

How a consolidated tape could address bond liquidity fragmentation

Chris Murphy, CEO of Ediphy, writes that the biggest goal of a fixed-income tape should be the aggregation of, and democratized access to, market data.

Tech VC funding: It’s not just about the money

The IMD Wrap: It’s been a busy year for tech and data companies seeking cash to kick-start new efforts. Max details how some are putting the fun into fundraising.

BNY uses proprietary data store to connect disparate applications

Internally built ODS is the “bedrock” upon which BNY plans to become more than just a custodian bank.

Waters Wavelength Ep. 296: Questions about data quality

It’s all about the data, data, data.

The AI boom proves a boon for chief data officers

Voice of the CDO: As trading firms incorporate AI and large language models into their investment workflows, there’s a growing realization among firms that their data governance structures are riddled with holes. Enter the chief data officer.

FactSet launches conversational AI for increased productivity

FactSet is set to release a generative AI search agent across its platform in early 2025.

If M&A picks up, who’s on the auction block?

Waters Wrap: With projections that mergers and acquisitions are geared to pick back up in 2025, Anthony reads the tea leaves of 25 of this year’s deals to predict which vendors might be most valuable.

ICE Connect adds data integration capabilities for proprietary data

Intercontinental Exchange’s desktop platform is collaborating with CloudQuant to allow customers to integrate in-house data and analytics with the datasets found on its ICE Connect platform.