May 2015: Tall Poppy Syndrome is Alive and Well

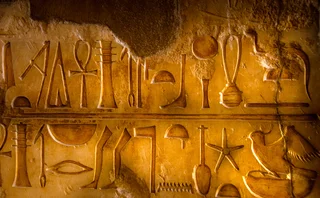

Bloomberg Professional's blank day on April 17.

Some know it as tall poppy syndrome, while others explain the phenomenon metaphorically as the tallest trees catching the most wind—the somewhat disturbing, yet universally prevalent, behavior where people take particular delight in a high-profile person or organization being brought down a peg or two. Sometimes it’s not necessarily a bad thing when the mighty fall—falling keeps their feet on the ground and adds a bit of humility to the mix. In short, we tend to love people a little bit more when they show their fallibility.

Such an incident happened in our industry fairly recently. As everyone connected to the capital markets pretty much knows by now, Bloomberg experienced an unprecedented outage on Friday April 17 leaving large numbers of its ubiquitous Bloomberg Professional terminals blank across several markets, making it impossible trade. The last time a similar incident occurred was back in 2006, when Reuters experienced a comparable event.

To their credit, the Bloomberg folks at this year’s Sell-Side Technology Awards in New York held up their hands and took the resulting criticism on the chin, acknowledging that they weren’t proud of the news, but that the circumstances surrounding the outage were exceptional and that everything would be done to ensure that this sort of thing wouldn’t happen again. Ironically, the fact that news of the outage spread so quickly, is an acknowledgement of not only the vital role Bloomberg plays in the orderly functioning of the global capital markets, but more significantly, it emphasizes the service levels and reliability the industry has come to expect from the New York-based provider.

So, was the outage disruptive? Yes. Was it unacceptable? Yes. Was it intentional? Of course not. Are heads going to roll as a result of the fiasco? Probably. But you can rest assured that, given the firm’s attention to detail and its reputation, it is turning over stones as I write to ensure that such incidents do not happen again. Sure there’s always a slim chance, but it’s unlikely we will experience an identical disruption, although outages are bound to occur. In fact, they may even become more common, given the levels of sophistication and increasing instances of cyber attacks on capital markets firms.

Understandably, there was much finger pointing and criticism leveled at Bloomberg in the wake of the April 17 outage, with some commentators arguing that the firm had become “too big to fail.” I would counter those assertions by encouraging Bloomberg clients to vote with their feet and take their business to another provider. Good luck with that.

So, was the outage disruptive? Yes. Was it unacceptable? Yes. Was it intentional? Of course not. Are heads going to roll as a result of the fiasco? Probably

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

Waters Wavelength Ep. 300: Reflecting on humble beginnings

It is our 300th episode! Tony and Shen reflect on how it all started.

An inside look: How AI powered innovation in the capital markets in 2024

From generative AI and machine learning to more classical forms of AI, banks, asset managers, exchanges, and vendors looked to large language models, co-pilots, and other tools to drive analytics.

Asset manager Saratoga uses AI to accelerate Ridgeline rollout

The tech provider’s AI assistant helps clients summarize research, client interactions, report generation, as well as interact with the Ridgeline platform.

LSEG rolls out AI-driven collaboration tool, preps Excel tie-in

Nej D’Jelal tells WatersTechnology that the rollout took longer than expected, but more is to come in 2025.

The Waters Cooler: ’Tis the Season!

Everyone is burned out and tired and wants to just chillax in the warm watching some Securities and Exchange Commission videos on YouTube. No? Just me?

It’s just semantics: The web standard that could replace the identifiers you love to hate

Data ontologists say that the IRI, a cousin of the humble URL, could put the various wars over identity resolution to bed—for good.

T. Rowe Price’s Tasitsiomi on the pitfalls of data and the allures of AI

The asset manager’s head of AI and investments data science gets candid on the hype around generative AI and data transparency.

As vulnerability patching gets overwhelming, it’s no-code’s time to shine

Waters Wrap: A large US bank is going all in on a no-code provider in an effort to move away from its Java stack. The bank’s CIO tells Anthony they expect more CIOs to follow this dev movement.