Sentiment

Bloomberg offers auto-RFQ chat feed—but banks want a bigger prize

Traders hope for unfettered access to IB chat so they can build their own AI-enhanced trading tools

Bloomberg deploys new chatbot tool to Terminal

The offering allows users to surface data and notifications from internal systems without ever having to leave Instant Bloomberg chatrooms.

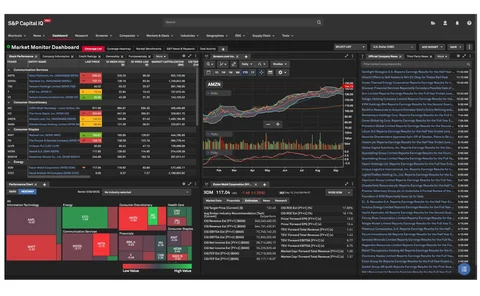

S&P tests ‘ChatIQ’ genAI search tool in revamped CapIQ desktop

The new tool is the culmination of integrating recent acquisitions, including IHS Markit, ChartIQ and Kensho.

Waters Wrap: The path to generative AI is paved with solid data practices

While large language models are likely to proliferate, those that can develop a solid data infrastructure of taxonomies, ontologies, data sourcing, mapping and lineage will be the ultimate winners, Anthony says.

Waters Wrap: ChatGPT and the next wave of AI evolution

As the December holiday break loomed, a new tool released by OpenAI had engineers, analysts, programmers and even writers like Anthony wondering what the future of their professions might hold.

Here’s what ML and NLP powered in capital markets in 2022

As machine learning and natural language processing continue to spread across the industry, WatersTechnology highlights stories from 2022 that feature new use cases.

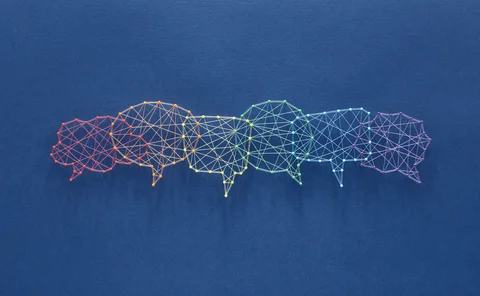

All the pieces fit: connecting trader voice and messaging across workflows

Cloud9 expands Symphony's communication channels to trader voice, in an effort to simplify workflows as Wall Street struggles with compliant communications.

Continuous evolution: Researchers work to specialize NLP for finance

From academics to data teams at investment banks, those in and adjacent to the capital markets are looking to specialize natural language processing models to understand and break down financial data.

Advancements in NLP bring focus to document insight

Vendors are looking to provide AI models to help financial professionals get more value out of unstructured data sources.

In the world of financial data, context—not content—is the new king

For years, the mantra of the market data world has been ‘content is king.’ But with trading strategies now more dependent on being able to see the big picture, the value of context could quickly overtake the data itself.

Meme stocks, Reddit, and QAnon: A postcard from the origin of the metaverse

Join WatersTechnology for a look back at the most absurd stories of the year—Reddit/GameStop, the advent of meme stocks, and QAnon—and what they mean for you.

Machine learning & NLP in the capital markets: Some examples from 2021

To show how ML and NLP are spreading across the industry, WatersTechnology highlights 20 stories from the last 12 months that feature unique uses of AI.

This Week: LSEG/Quantile, Ice, Morningstar/Sentifi, SimCorp/FundApps, and more

A summary of some of the past week’s financial technology news.

ESG asset manager taps Symphony, FinTech Studios for thematic ‘mini-Bloomberg’

Sycomore Asset Management is preparing to roll out an expansion of how it uses the vendors’ combined platforms to be able to create and share targeted thematic investment data across its organization.

Disinformation campaigns coming to a Wall Street near you

Rebecca examines the tangled web woven between Reddit, meme stocks, and QAnon, and asks how well prepared data providers looking to jump on the meme stocks bandwagon are to recognize organized disinformation campaigns.

Meme stocks: Data providers conflicted on offering investment analyses

While some alternative data providers are jumping in on the meme-stock craze by producing new datasets and analyses geared toward risk management and alpha generation, others—perhaps rightly so—are staying cautious.

Putting the ‘green’ in green data: Rise of impact investing drives ESG M&A

Socially responsible investors are putting their money where their mouth is—in ever-increasing amounts. With insatiable demand for new datasets and analytics to support these strategies, it’s not surprising that every data vendor wants a slice of the ESG…

Ping An Asset Management zooms in on NLP models for sentiment analysis

The asset management arm of Ping An Insurance (Group) Company of China is enhancing its NLP models to solve complex, non-linear challenges such as overfitting.

Small alt data providers feel pressure to specialize

GTCOM-US, once a bespoke alt data shop for the buy side, has narrowed its offering to focus on Chinese datasets as the largest alt data players get even bigger.

Waters Wrap: The nature of data and information (And Ion-List thoughts)

Anthony takes a look at the alternative data industry post-GameStop, and wonders about Ion Group’s strategy going forward after recent acquisitions.

Data disruptors face uphill battle to overcome credit ratings stagnation

With traditional ratings agencies facing increased hostility from financial firms, new entrants are hoping to reshape ratings. But will fresh approaches appeal to an industry underwhelmed by existing offerings?