Quantifi

Selwood AM Taps Quantifi for Integrated Portfolio Management System

London-based credit specialist to use Quanitfi solution as holistic platform for trading, risk management and operations.

NewOak Deploys Quantifi Pricing, Analytics Tool

The Quantifi pricing tool will help NewOak improve hte services it provides to clients to make better decisions based on more accurate pricing.

NewOak Plumps for Quantifi’s Single Pricing and Analytics Platform

NewOak Capital is set to implement Quantifi’s integrated pricing and analytics platform to bolster its analytics capabilities across credit, FX and rates markets.

Helaba Selects Quantifi xVA Platform for Counterparty Risk Management

German bank replaces in-house xVA solution for counterparty risk mitigation and management.

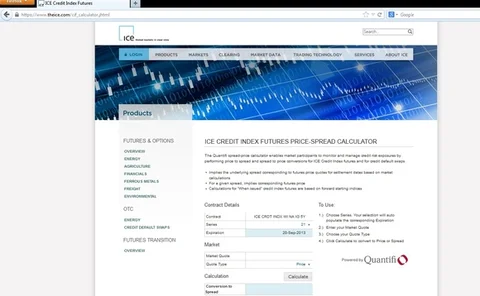

Quantifi Tapped for ICE Futures Price-Spread Calculator

The analytics provider has released a new tool for pricing credit index futures listed by IntercontinentalExchange (ICE) Futures U.S., backing increased demand for exchange-traded futures, which trade more cheaply than OTC derivatives under new global…

Counterparty Credit Models Herald New Workflows

Initial cost and hardware limitations are often tallied as potential problems for sell-side firms complying with new capital-charge requirements by optimizing netting strategies and collateral usage. Now those firms face a different challenge: where to…

Quantifi Releases V11.0 of Pricing and Risk Product

Over-the-counter software provider Quantifi has released version 11.0 of its pricing and risk analysis software, with improvements to enterprise risk performance and valuation scalability.

JC Rathbone Taps Quantifi for CVA Analytics

The risk management and advisory services consultancy firm, JC Rathbone Associates (JCRA), has selected Quantifi’s credit valuation adjustment (CVA) product as its primary solution for counterparty risk analytics.

Quantifi Hires Raveschoot as Head of EMEA Ops

Quantifi, the New York-based provider of analytics, trading, and risk management technology to the global OTC markets, has appointed Bruno Piers de Raveschoot as head of the firm’s EMEA operation.

Art and Science: Credit Valuation Challenge II

Although the technical requirements for calculating credit valuation adjustment can be significant, other factors also need to be considered in order for an efficient counterparty risk management operation to be established. The second part of this…

KLP Asset Management Chooses Quantifi for Interest Rate Derivatives

Nordic investment management firm KLP Kapitalforvaltning AS (KLP Asset Management) is using Quantifi's technology for risk management and the pricing of interest rate derivatives.