eVestment

Nasdaq reshuffles tech divisions post-Adenza

Adenza is now fully integrated into the exchange operator’s ecosystem, bringing opportunities for new business and a fresh perspective on how fintech fits into its strategy.

China’s Asset Managers See More Interest from Foreign Investors

There’s an opportunity for Chinese asset managers looking to attract foreign investors, but transparency remains an issue.

Nasdaq Adds New Alt Data to Analytics Hub

Nasdaq has bolstered its Analytics Hub with four new sources of alternative data.

Bell to Head Marketing for Investment Metrics

Investment analytics and reporting firm appoints new addition to the marketing leadership team.

Nasdaq Acquires Buy-Side Analytics Provider eVestment

The acquisition is part of a wider strategy by the exchange to offer more data products which may appeal to the buy side

eVestment Builds Private Fund Data Alliance

The alliance will establish standards for reporting private equity fund performance data.

Risky Alternative: Solving Enterprise Risk for Alternative Investments

As institutional investors increase their allocations to alternative investments, they’re finding that they need to improve their analytical capabilities when it comes to monitoring enterprise risk.

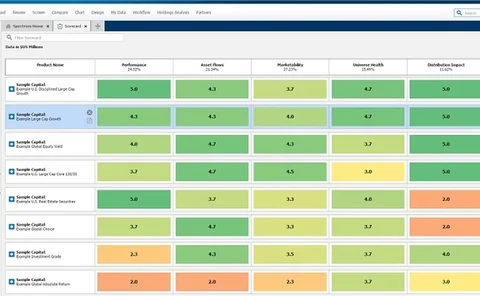

eVestment's ‘Scorecard' Aims to Help Fund Managers Find New Investors

Scorecard is a cloud-based module.

eVestment Adds Nasdaq Index Data

Nasdaq OMX has begun distributing data on its Nasdaq Global Index Family and Nasdaq Dividend Achiever Indexes via fund management software provider eVestment’s suite of analytics products.

eVestment Launches Analytics, Portfolio Construction Platform

eVestment has launched Quantum Analytics, a cloud-based portfolio analysis and construction platform.

eVestment Adds HFR Hedge Fund Data

Atlanta, GA-based investment analytics software vendor eVestment is integrating alternative investment data and indexes from Hedge Fund Research-a Chicago-based provider of hedge fund industry databases, reports and indexes-into its suite of analytics…

Morningstar Bolsters Fund Data with eVestment Deal

Chicago-based investment research and data provider Morningstar will make fund management software provider eVestment's database of more than 22,000 separate accounts and 23,000 hedge funds data available to users of its Morningstar Direct investment…

eVestment Adds Morningstar Data to Analytics Suite

Atlanta-based data and analytics provider eVestment will now include Morningstar data in its own suite of analytics solutions, including the recently acquired platforms from PerTrac and Fundspire.

eVestment Integrates Morningstar Data

The data provider, which mostly collects and distributes its own institutional investment information, is easing Morningstar data into its mix, through past acquisitions

eVestment Integrates Morningstar Data into Analytics Tools

Data from Chicago-based investment research and data provider Morningstar is now available via fund management software provider eVestment's analytics solutions suite, including its PerTrac and Fundspire systems.

eVestment Unveils New Attribution Platform

Analytics provider eVestment has launched a new attribution platform, eVestment Attribution, which will provide asset managers with insight into how portfolio returns are generated.

eVestment's Minnick Discusses Recent Acquisitions

Jim Minnick, eVestment Alliance's founder and CEO, sat down with Buy-Side Technology to discuss the firm's recent acquisitions and look ahead at what's to come.

eVestment Nabs PerTrac, Fundspire in Continued Alternative Investments Push

Atlanta-based eVestment, which provides institutional investment data and cloud-based analytic solutions, has acquired both PerTrac and Fundspire, both of which offer buy-side tailored solutions.