CFTC Sets Up Lab to Connect with Fintech Firms

LabCFTC will help guide firms through CFTC rules and open the agency to updating its regulations to meet changing market conditions.

The program is called LabCFTC and offers fintech firms a place to seek guidance on current CFTC regulations. The initiative has two core components: GuidePoint—to be located in downtown New York—which will be a direct point of contact to engage with the regulator; and CFTC 2.0, which will look at how the CFTC can use emerging technology to keep pace with the market.

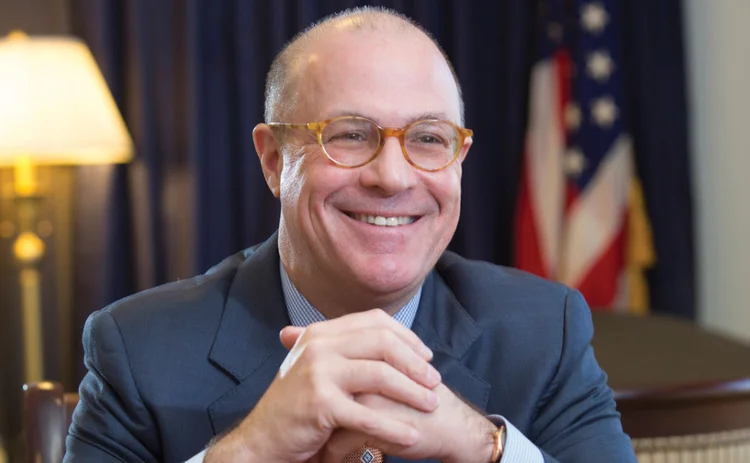

CFTC acting chairman Christopher Giancarlo says the outreach is in recognition of the place fintech firms have in the market, and to encourage innovation.

“To be clear, we are not going to tell someone whether their business plan is a billion dollar idea, or even a good idea; others are far better positioned to do that. Nor will GuidePoint provide legal advice. That is not our job as regulators. We are not a substitute for good legal counsel,” Giancarlo says. “But what we hope to offer is timely, meaningful and useful feedback on the regulatory context of proposed fintech innovations.”

The CFTC follows the Office of the Comptroller of the Currency (OCC) in reaching out to fintech firms. The OCC is working on allowing firms to apply for special purpose national bank charters, which will enable them to operate as a bank. That plan has faced opposition from the Conference of State Bank Supervisors, which filed a lawsuit in April.

The other component of the initiative is an effort to use technology within the agency. Part of the plan is to establish an internal fintech innovation lab to identify useful applications and explore how emerging technologies like distributed ledger can enhance CFTC tasks.

Giancarlo says the CFTC is cognizant that its rules were mostly written for analog trading markets that have now been replaced by electronic trading, and need to be updated.

“By engaging with fintech firms, we will learn where the friction points are between innovation and our regulations. Through LabCFTC, we will be able to put our rules under the tension of innovation. This is not only good for markets, innovation, jobs and growth—it is good for us too,” he said. “As regulators, we know that our rules were mostly written for 20th century analog trading markets—the kind of markets in which Eddie Murphy famously bid up the price of orange juice future in the movie Trading Places.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Regulation

Nasdaq leads push to reform options regulatory fee

A proposed rule change would pare costs for traders, raise them for banks, and defund smaller venues.

The CAT declawed as Citadel’s case reaches end game

The SEC reduced the CAT’s capacity to collect information on investors, in a move that will have knock-on effects for its ongoing funding model case with Citadel.

Waters Wavelength Ep. 305: Cato Institute's Jennifer Schulp

Jennifer joins to discuss what regulatory priorities might look under Paul Atkin's SEC.

Examining Cboe’s lawsuit appealing SEC’s OEMS rule rejection

The Chicago-based exchange has sued the regulator in the Seventh Circuit Court of Appeals after the agency blocked a proposed rule that would change how Silexx is classified.

European exchange data prices surge, new study shows

The report analyzed market data prices and fee structures from 2017 to 2024 and found that fee schedules have increased exponentially. Several exchanges say the findings are misleading.

Regis-TR and the Emir Refit blame game

The reporting overhaul was been marred by problems at repositories, prompting calls to stagger future go-live dates.

FCA: Consolidated tape for UK equities won’t happen until 2028

At an event last week, the FCA proposed a new timeline for the CT, which received pushback from participants, according to sources.

Cusip Global Services wants to know, ‘What’s your damage?’

The evidence and discovery phase of the case against the identifier bureau is set to expire in March, bringing an anticipated jury trial one step closer.